Page 273 - Bank Muamalat_AR24

P. 273

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 271

23. RECOURSE OBLIGATION ON FINANCING SOLD TO CAGAMAS

This represents the proceeds received from house financing sold directly to Cagamas Berhad with recourse to the Bank.

Under these agreements, the Bank undertakes to administer the financing on behalf of Cagamas Berhad and to buy-back

any financing which are regarded as defective based on prudential criteria set by Cagamas Berhad. These financial liabilities

are stated at amortised cost.

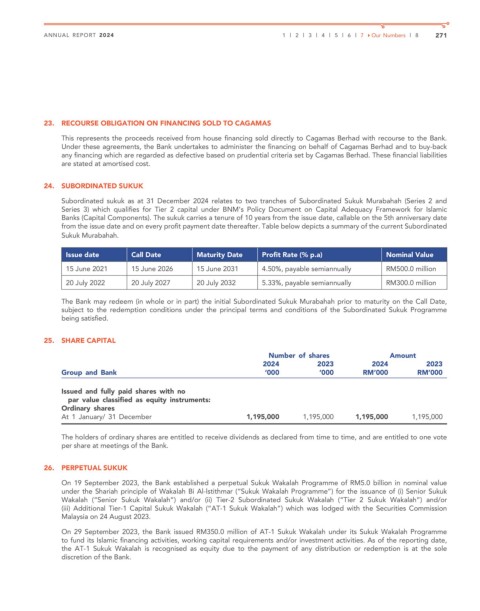

24. SUBORDINATED SUKUK

Subordinated sukuk as at 31 December 2024 relates to two tranches of Subordinated Sukuk Murabahah (Series 2 and

Series 3) which qualifies for Tier 2 capital under BNM’s Policy Document on Capital Adequacy Framework for Islamic

Banks (Capital Components). The sukuk carries a tenure of 10 years from the issue date, callable on the 5th anniversary date

from the issue date and on every profit payment date thereafter. Table below depicts a summary of the current Subordinated

Sukuk Murabahah.

Issue date Call Date Maturity Date Profit Rate (% p.a) Nominal Value

15 June 2021 15 June 2026 15 June 2031 4.50%, payable semiannually RM500.0 million

20 July 2022 20 July 2027 20 July 2032 5.33%, payable semiannually RM300.0 million

The Bank may redeem (in whole or in part) the initial Subordinated Sukuk Murabahah prior to maturity on the Call Date,

subject to the redemption conditions under the principal terms and conditions of the Subordinated Sukuk Programme

being satisfied.

25. SHARE CAPITAL

Number of shares Amount

2024 2023 2024 2023

Group and Bank ‘000 ‘000 RM’000 RM’000

Issued and fully paid shares with no

par value classified as equity instruments:

Ordinary shares

At 1 January/ 31 December 1,195,000 1,195,000 1,195,000 1,195,000

The holders of ordinary shares are entitled to receive dividends as declared from time to time, and are entitled to one vote

per share at meetings of the Bank.

26. PERPETUAL SUKUK

On 19 September 2023, the Bank established a perpetual Sukuk Wakalah Programme of RM5.0 billion in nominal value

under the Shariah principle of Wakalah Bi Al-lstithmar (“Sukuk Wakalah Programme”) for the issuance of (i) Senior Sukuk

Wakalah (“Senior Sukuk Wakalah”) and/or (ii) Tier-2 Subordinated Sukuk Wakalah (“Tier 2 Sukuk Wakalah”) and/or

(iii) Additional Tier-1 Capital Sukuk Wakalah (“AT-1 Sukuk Wakalah”) which was lodged with the Securities Commission

Malaysia on 24 August 2023.

On 29 September 2023, the Bank issued RM350.0 million of AT-1 Sukuk Wakalah under its Sukuk Wakalah Programme

to fund its Islamic financing activities, working capital requirements and/or investment activities. As of the reporting date,

the AT-1 Sukuk Wakalah is recognised as equity due to the payment of any distribution or redemption is at the sole

discretion of the Bank.