Page 346 - Bank Muamalat_AR24

P. 346

344 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

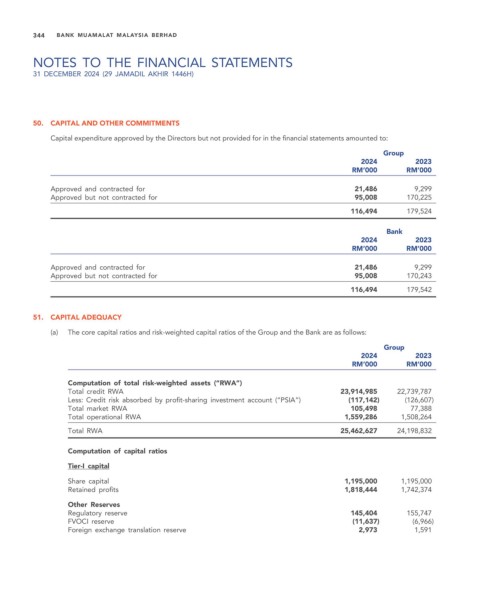

50. CAPITAL AND OTHER COMMITMENTS

Capital expenditure approved by the Directors but not provided for in the financial statements amounted to:

Group

2024 2023

RM’000 RM’000

Approved and contracted for 21,486 9,299

Approved but not contracted for 95,008 170,225

116,494 179,524

Bank

2024 2023

RM’000 RM’000

Approved and contracted for 21,486 9,299

Approved but not contracted for 95,008 170,243

116,494 179,542

51. CAPITAL ADEQUACY

(a) The core capital ratios and risk-weighted capital ratios of the Group and the Bank are as follows:

Group

2024 2023

RM’000 RM’000

Computation of total risk-weighted assets (“RWA”)

Total credit RWA 23,914,985 22,739,787

Less: Credit risk absorbed by profit-sharing investment account (“PSIA”) (117,142) (126,607)

Total market RWA 105,498 77,388

Total operational RWA 1,559,286 1,508,264

Total RWA 25,462,627 24,198,832

Computation of capital ratios

Tier-I capital

Share capital 1,195,000 1,195,000

Retained profits 1,818,444 1,742,374

Other Reserves

Regulatory reserve 145,404 155,747

FVOCI reserve (11,637) (6,966)

Foreign exchange translation reserve 2,973 1,591