Page 419 - Bank Muamalat_AR24

P. 419

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 417

10.0 SHARIAH GOVERNANCE DISCLOSURES (CONT’D)

Rectification Process of Shariah Non-Compliance Income (“SNCI”) and Unidentified Funds

Earning Prohibited by Shariah

The Bank defines the principles for managing Shariah Non-Compliance Income (“SNCI”) in its Policy on Shariah Risk

Management while the operational practices and procedures to be applied in managing SNCI are outlined in the Guidelines

on Shariah Risk Management.

SNCI is an income generated from any transaction(s) that breaches the governing Shariah principles and requirements as

determined by the Bank’s SC and/or other Shariah Authorities (SA).

The SA are as follows:

• Shariah Advisory Council of Bank Negara Malaysia.

• Shariah Advisory Council of Securities Commission Malaysia.

• Any other relevant Shariah resolutions and rulings as prescribed and determined by the SC of the Bank from to time.

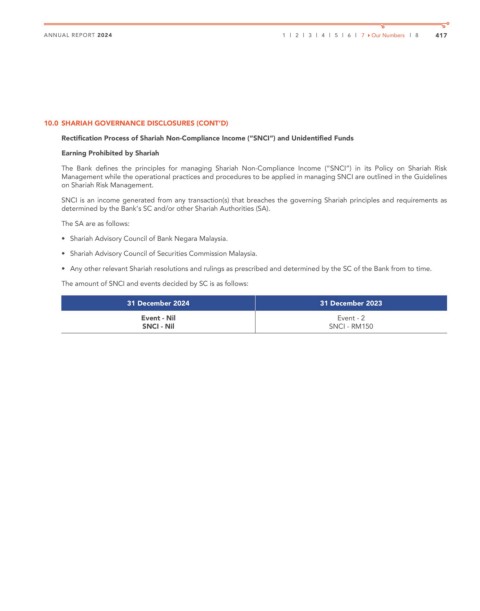

The amount of SNCI and events decided by SC is as follows:

31 December 2024 31 December 2023

Event - Nil Event - 2

SNCI - Nil SNCI - RM150