Page 77 - Bank Muamalat_AR24

P. 77

ANNUAL REPORT 2024 1 2 3 4 Our Business Performance 5 6 7 8 75

MUAMALAT VENTURE SDN BHD (“MVSB”) FY2024

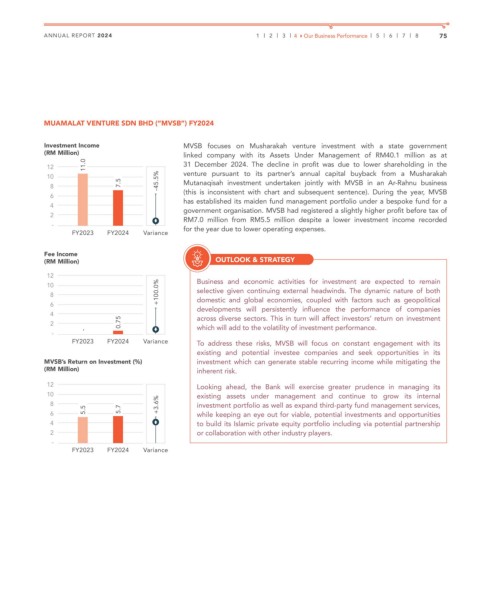

Investment Income MVSB focuses on Musharakah venture investment with a state government

(RM Million) linked company with its Assets Under Management of RM40.1 million as at

11.0 31 December 2024. The decline in profit was due to lower shareholding in the

12

10 -45.5% venture pursuant to its partner’s annual capital buyback from a Musharakah

8 7.5 Mutanaqisah investment undertaken jointly with MVSB in an Ar-Rahnu business

6 (this is inconsistent with chart and subsequent sentence). During the year, MVSB

has established its maiden fund management portfolio under a bespoke fund for a

4

government organisation. MVSB had registered a slightly higher profit before tax of

2 RM7.0 million from RM5.5 million despite a lower investment income recorded

- for the year due to lower operating expenses.

FY2023 FY2024 Variance

Fee Income

(RM Million) OUTLOOK & STRATEGY

12

10 Business and economic activities for investment are expected to remain

selective given continuing external headwinds. The dynamic nature of both

8 +100.0% domestic and global economies, coupled with factors such as geopolitical

6 developments will persistently influence the performance of companies

4 across diverse sectors. This in turn will affect investors’ return on investment

2 0.75 which will add to the volatility of investment performance.

- -

FY2023 FY2024 Variance To address these risks, MVSB will focus on constant engagement with its

existing and potential investee companies and seek opportunities in its

MVSB’s Return on Investment (%) investment which can generate stable recurring income while mitigating the

(RM Million) inherent risk.

12 Looking ahead, the Bank will exercise greater prudence in managing its

10 existing assets under management and continue to grow its internal

8 +3.6% investment portfolio as well as expand third-party fund management services,

6 5.5 5.7 while keeping an eye out for viable, potential investments and opportunities

4 to build its Islamic private equity portfolio including via potential partnership

2 or collaboration with other industry players.

-

FY2023 FY2024 Variance