Page 101 - HRC_Annual_Report_2023

P. 101

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 99

Other Information

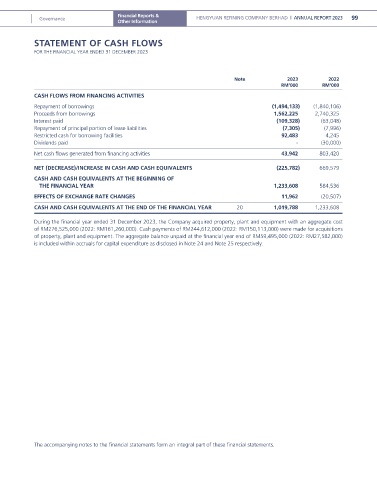

STATEMENT OF CASH FLOWS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

Note 2023 2022

RM’000 RM’000

CASH FLOWS FROM FINANCING ACTIVITIES

Repayment of borrowings (1,494,133) (1,840,106)

Proceeds from borrowings 1,562,225 2,740,325

Interest paid (109,328) (63,048)

Repayment of principal portion of lease liabilities (7,305) (7,996)

Restricted cash for borrowing facilities 92,483 4,245

Dividends paid - (30,000)

Net cash flows generated from financing activities 43,942 803,420

NET (DECREASE)/INCREASE IN CASH AND CASH EQUIVALENTS (225,782) 669,579

CASH AND CASH EQUIVALENTS AT THE BEGINNING OF

THE FINANCIAL YEAR 1,233,608 584,536

EFFECTS OF EXCHANGE RATE CHANGES 11,962 (20,507)

CASH AND CASH EQUIVALENTS AT THE END OF THE FINANCIAL YEAR 20 1,019,788 1,233,608

During the financial year ended 31 December 2023, the Company acquired property, plant and equipment with an aggregate cost

of RM276,525,000 (2022: RM161,260,000). Cash payments of RM244,612,000 (2022: RM150,113,000) were made for acquisitions

of property, plant and equipment. The aggregate balance unpaid at the financial year end of RM59,495,000 (2022: RM27,582,000)

is included within accruals for capital expenditure as disclosed in Note 24 and Note 25 respectively.

The accompanying notes to the financial statements form an integral part of these financial statements.