Page 12 - Bank Muamalat_AR24

P. 12

10 BANK MUAMALAT MALAYSIA BERHAD

ASSETS

PERFORMANCE

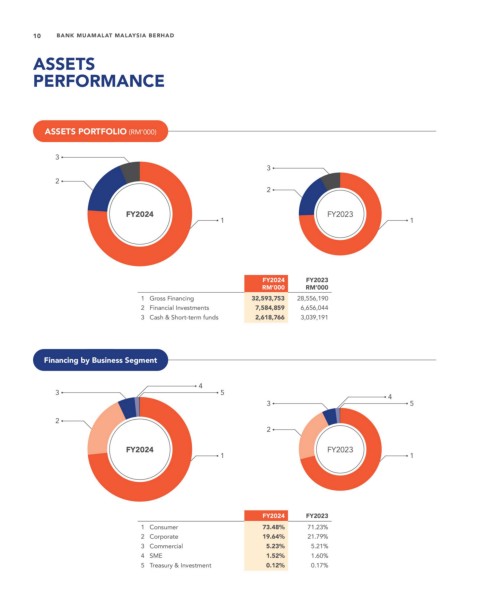

ASSETS PORTFOLIO (RM’000)

3

3

2

2

FY2024 FY2023

1 1

FY2024 FY2023

RM’000 RM’000

1 Gross Financing 32,593,753 28,556,190

2 Financial Investments 7,584,859 6,656,044

3 Cash & Short-term funds 2,618,766 3,039,191

Financing by Business Segment

4

3 5

4

3 5

2

2

FY2024 FY2023

1 1

FY2024 FY2023

1 Consumer 73.48% 71.23%

2 Corporate 19.64% 21.79%

3 Commercial 5.23% 5.21%

4 SME 1.52% 1.60%

5 Treasury & Investment 0.12% 0.17%