Page 161 - Bank Muamalat_AR24

P. 161

ANNUAL REPORT 2024 1 2 3 4 5 6 Governance 7 8 159

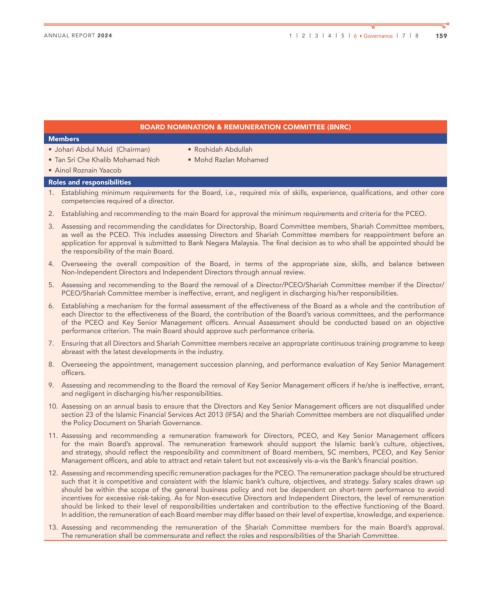

BOARD NOMINATION & REMUNERATION COMMITTEE (BNRC)

Members

• Johari Abdul Muid (Chairman) • Roshidah Abdullah

• Tan Sri Che Khalib Mohamad Noh • Mohd Razlan Mohamed

• Ainol Roznain Yaacob

Roles and responsibilities

1. Establishing minimum requirements for the Board, i.e., required mix of skills, experience, qualifications, and other core

competencies required of a director.

2. Establishing and recommending to the main Board for approval the minimum requirements and criteria for the PCEO.

3. Assessing and recommending the candidates for Directorship, Board Committee members, Shariah Committee members,

as well as the PCEO. This includes assessing Directors and Shariah Committee members for reappointment before an

application for approval is submitted to Bank Negara Malaysia. The final decision as to who shall be appointed should be

the responsibility of the main Board.

4. Overseeing the overall composition of the Board, in terms of the appropriate size, skills, and balance between

Non-Independent Directors and Independent Directors through annual review.

5. Assessing and recommending to the Board the removal of a Director/PCEO/Shariah Committee member if the Director/

PCEO/Shariah Committee member is ineffective, errant, and negligent in discharging his/her responsibilities.

6. Establishing a mechanism for the formal assessment of the effectiveness of the Board as a whole and the contribution of

each Director to the effectiveness of the Board, the contribution of the Board’s various committees, and the performance

of the PCEO and Key Senior Management officers. Annual Assessment should be conducted based on an objective

performance criterion. The main Board should approve such performance criteria.

7. Ensuring that all Directors and Shariah Committee members receive an appropriate continuous training programme to keep

abreast with the latest developments in the industry.

8. Overseeing the appointment, management succession planning, and performance evaluation of Key Senior Management

officers.

9. Assessing and recommending to the Board the removal of Key Senior Management officers if he/she is ineffective, errant,

and negligent in discharging his/her responsibilities.

10. Assessing on an annual basis to ensure that the Directors and Key Senior Management officers are not disqualified under

section 23 of the Islamic Financial Services Act 2013 (IFSA) and the Shariah Committee members are not disqualified under

the Policy Document on Shariah Governance.

11. Assessing and recommending a remuneration framework for Directors, PCEO, and Key Senior Management officers

for the main Board’s approval. The remuneration framework should support the Islamic bank’s culture, objectives,

and strategy, should reflect the responsibility and commitment of Board members, SC members, PCEO, and Key Senior

Management officers, and able to attract and retain talent but not excessively vis-a-vis the Bank’s financial position.

12. Assessing and recommending specific remuneration packages for the PCEO. The remuneration package should be structured

such that it is competitive and consistent with the Islamic bank’s culture, objectives, and strategy. Salary scales drawn up

should be within the scope of the general business policy and not be dependent on short-term performance to avoid

incentives for excessive risk-taking. As for Non-executive Directors and Independent Directors, the level of remuneration

should be linked to their level of responsibilities undertaken and contribution to the effective functioning of the Board.

In addition, the remuneration of each Board member may differ based on their level of expertise, knowledge, and experience.

13. Assessing and recommending the remuneration of the Shariah Committee members for the main Board’s approval.

The remuneration shall be commensurate and reflect the roles and responsibilities of the Shariah Committee.