Page 162 - Bank Muamalat_AR24

P. 162

160 BANK MUAMALAT MALAYSIA BERHAD

GOVERNANCE DISCLOSURES

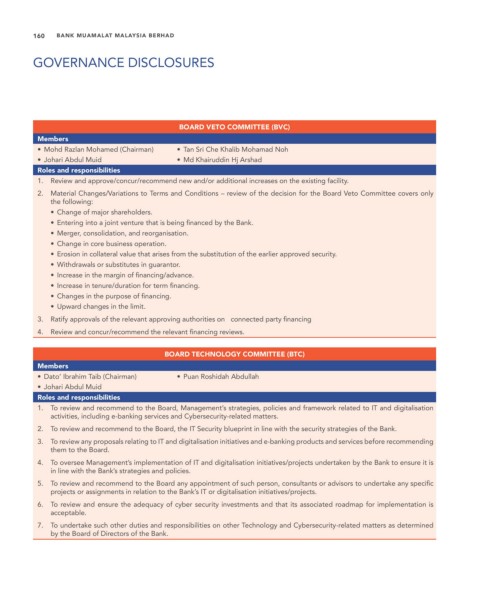

BOARD VETO COMMITTEE (BVC)

Members

• Mohd Razlan Mohamed (Chairman) • Tan Sri Che Khalib Mohamad Noh

• Johari Abdul Muid • Md Khairuddin Hj Arshad

Roles and responsibilities

1. Review and approve/concur/recommend new and/or additional increases on the existing facility.

2. Material Changes/Variations to Terms and Conditions – review of the decision for the Board Veto Committee covers only

the following:

• Change of major shareholders.

• Entering into a joint venture that is being financed by the Bank.

• Merger, consolidation, and reorganisation.

• Change in core business operation.

• Erosion in collateral value that arises from the substitution of the earlier approved security.

• Withdrawals or substitutes in guarantor.

• Increase in the margin of financing/advance.

• Increase in tenure/duration for term financing.

• Changes in the purpose of financing.

• Upward changes in the limit.

3. Ratify approvals of the relevant approving authorities on connected party financing

4. Review and concur/recommend the relevant financing reviews.

BOARD TECHNOLOGY COMMITTEE (BTC)

Members

• Dato’ Ibrahim Taib (Chairman) • Puan Roshidah Abdullah

• Johari Abdul Muid

Roles and responsibilities

1. To review and recommend to the Board, Management’s strategies, policies and framework related to IT and digitalisation

activities, including e-banking services and Cybersecurity-related matters.

2. To review and recommend to the Board, the IT Security blueprint in line with the security strategies of the Bank.

3. To review any proposals relating to IT and digitalisation initiatives and e-banking products and services before recommending

them to the Board.

4. To oversee Management’s implementation of IT and digitalisation initiatives/projects undertaken by the Bank to ensure it is

in line with the Bank’s strategies and policies.

5. To review and recommend to the Board any appointment of such person, consultants or advisors to undertake any specific

projects or assignments in relation to the Bank’s IT or digitalisation initiatives/projects.

6. To review and ensure the adequacy of cyber security investments and that its associated roadmap for implementation is

acceptable.

7. To undertake such other duties and responsibilities on other Technology and Cybersecurity-related matters as determined

by the Board of Directors of the Bank.