Page 297 - Bank Muamalat_AR24

P. 297

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 295

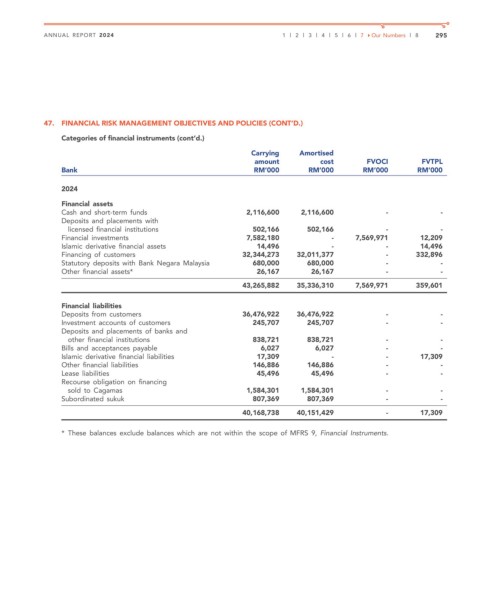

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

Categories of financial instruments (cont’d.)

Carrying Amortised

amount cost FVOCI FVTPL

Bank RM’000 RM’000 RM’000 RM’000

2024

Financial assets

Cash and short-term funds 2,116,600 2,116,600 - -

Deposits and placements with

licensed financial institutions 502,166 502,166 - -

Financial investments 7,582,180 - 7,569,971 12,209

Islamic derivative financial assets 14,496 - - 14,496

Financing of customers 32,344,273 32,011,377 - 332,896

Statutory deposits with Bank Negara Malaysia 680,000 680,000 - -

Other financial assets* 26,167 26,167 - -

43,265,882 35,336,310 7,569,971 359,601

Financial liabilities

Deposits from customers 36,476,922 36,476,922 - -

Investment accounts of customers 245,707 245,707 - -

Deposits and placements of banks and

other financial institutions 838,721 838,721 - -

Bills and acceptances payable 6,027 6,027 - -

Islamic derivative financial liabilities 17,309 - - 17,309

Other financial liabilities 146,886 146,886 - -

Lease liabilities 45,496 45,496 - -

Recourse obligation on financing

sold to Cagamas 1,584,301 1,584,301 - -

Subordinated sukuk 807,369 807,369 - -

40,168,738 40,151,429 - 17,309

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.