Page 393 - Bank Muamalat_AR24

P. 393

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 391

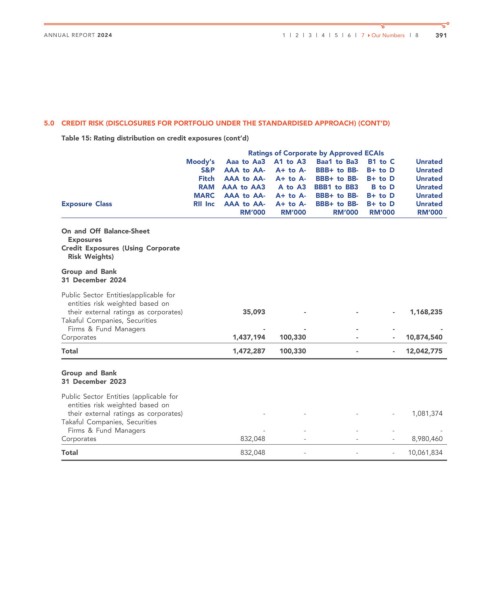

5.0 CREDIT RISK (DISCLOSURES FOR PORTFOLIO UNDER THE STANDARDISED APPROACH) (CONT’D)

Table 15: Rating distribution on credit exposures (cont’d)

Ratings of Corporate by Approved ECAIs

Moody’s Aaa to Aa3 A1 to A3 Baa1 to Ba3 B1 to C Unrated

S&P AAA to AA- A+ to A- BBB+ to BB- B+ to D Unrated

Fitch AAA to AA- A+ to A- BBB+ to BB- B+ to D Unrated

RAM AAA to AA3 A to A3 BBB1 to BB3 B to D Unrated

MARC AAA to AA- A+ to A- BBB+ to BB- B+ to D Unrated

Exposure Class RII Inc AAA to AA- A+ to A- BBB+ to BB- B+ to D Unrated

RM’000 RM’000 RM’000 RM’000 RM’000

On and Off Balance-Sheet

Exposures

Credit Exposures (Using Corporate

Risk Weights)

Group and Bank

31 December 2024

Public Sector Entities(applicable for

entities risk weighted based on

their external ratings as corporates) 35,093 - - - 1,168,235

Takaful Companies, Securities

Firms & Fund Managers - - - - -

Corporates 1,437,194 100,330 - - 10,874,540

Total 1,472,287 100,330 - - 12,042,775

Group and Bank

31 December 2023

Public Sector Entities (applicable for

entities risk weighted based on

their external ratings as corporates) - - - - 1,081,374

Takaful Companies, Securities

Firms & Fund Managers - - - - -

Corporates 832,048 - - - 8,980,460

Total 832,048 - - - 10,061,834