Page 399 - Bank Muamalat_AR24

P. 399

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 397

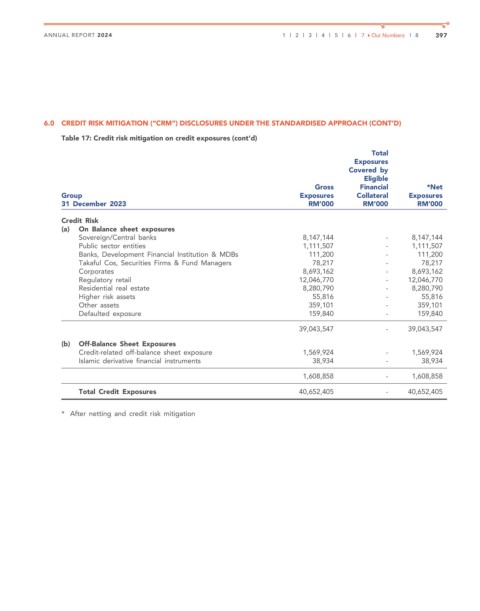

6.0 CREDIT RISK MITIGATION (“CRM”) DISCLOSURES UNDER THE STANDARDISED APPROACH (CONT’D)

Table 17: Credit risk mitigation on credit exposures (cont’d)

Total

Exposures

Covered by

Eligible

Gross Financial *Net

Group Exposures Collateral Exposures

31 December 2023 RM’000 RM’000 RM’000

Credit Risk

(a) On Balance sheet exposures

Sovereign/Central banks 8,147,144 - 8,147,144

Public sector entities 1,111,507 - 1,111,507

Banks, Development Financial Institution & MDBs 111,200 - 111,200

Takaful Cos, Securities Firms & Fund Managers 78,217 - 78,217

Corporates 8,693,162 - 8,693,162

Regulatory retail 12,046,770 - 12,046,770

Residential real estate 8,280,790 - 8,280,790

Higher risk assets 55,816 - 55,816

Other assets 359,101 - 359,101

Defaulted exposure 159,840 - 159,840

39,043,547 - 39,043,547

(b) Off-Balance Sheet Exposures

Credit-related off-balance sheet exposure 1,569,924 - 1,569,924

Islamic derivative financial instruments 38,934 - 38,934

1,608,858 - 1,608,858

Total Credit Exposures 40,652,405 - 40,652,405

* After netting and credit risk mitigation