Page 400 - Bank Muamalat_AR24

P. 400

398 BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

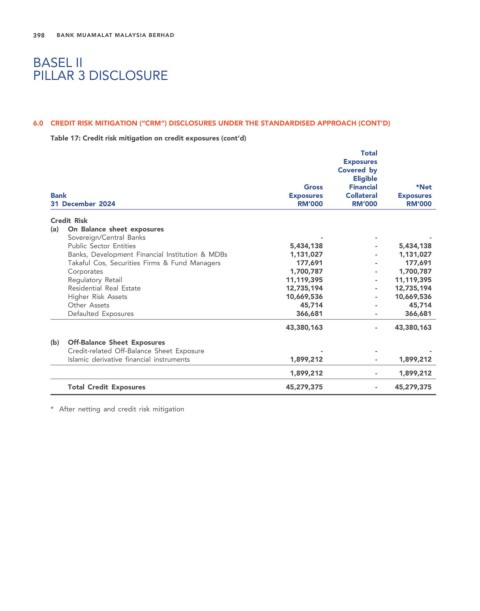

6.0 CREDIT RISK MITIGATION (“CRM”) DISCLOSURES UNDER THE STANDARDISED APPROACH (CONT’D)

Table 17: Credit risk mitigation on credit exposures (cont’d)

Total

Exposures

Covered by

Eligible

Gross Financial *Net

Bank Exposures Collateral Exposures

31 December 2024 RM’000 RM’000 RM’000

Credit Risk

(a) On Balance sheet exposures

Sovereign/Central Banks - - -

Public Sector Entities 5,434,138 - 5,434,138

Banks, Development Financial Institution & MDBs 1,131,027 - 1,131,027

Takaful Cos, Securities Firms & Fund Managers 177,691 - 177,691

Corporates 1,700,787 - 1,700,787

Regulatory Retail 11,119,395 - 11,119,395

Residential Real Estate 12,735,194 - 12,735,194

Higher Risk Assets 10,669,536 - 10,669,536

Other Assets 45,714 - 45,714

Defaulted Exposures 366,681 - 366,681

43,380,163 - 43,380,163

(b) Off-Balance Sheet Exposures

Credit-related Off-Balance Sheet Exposure - - -

Islamic derivative financial instruments 1,899,212 - 1,899,212

1,899,212 - 1,899,212

Total Credit Exposures 45,279,375 - 45,279,375

* After netting and credit risk mitigation