Page 88 - Bank Muamalat_AR24

P. 88

86 BANK MUAMALAT MALAYSIA BERHAD

STAKEHOLDER ENGAGEMENT

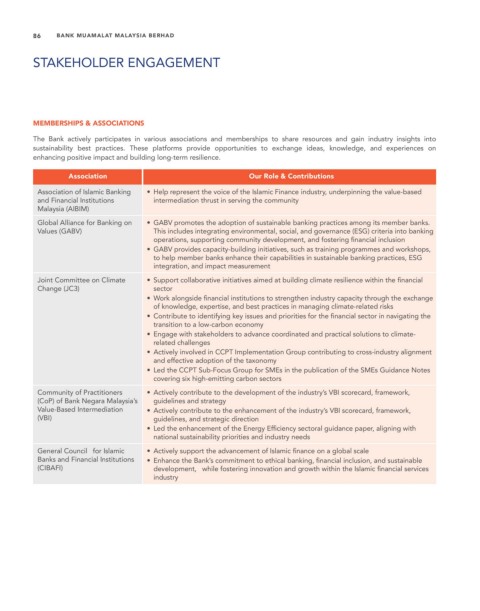

MEMBERSHIPS & ASSOCIATIONS

The Bank actively participates in various associations and memberships to share resources and gain industry insights into

sustainability best practices. These platforms provide opportunities to exchange ideas, knowledge, and experiences on

enhancing positive impact and building long-term resilience.

Association Our Role & Contributions

Association of Islamic Banking • Help represent the voice of the Islamic Finance industry, underpinning the value-based

and Financial Institutions intermediation thrust in serving the community

Malaysia (AIBIM)

Global Alliance for Banking on • GABV promotes the adoption of sustainable banking practices among its member banks.

Values (GABV) This includes integrating environmental, social, and governance (ESG) criteria into banking

operations, supporting community development, and fostering financial inclusion

• GABV provides capacity-building initiatives, such as training programmes and workshops,

to help member banks enhance their capabilities in sustainable banking practices, ESG

integration, and impact measurement

Joint Committee on Climate • Support collaborative initiatives aimed at building climate resilience within the financial

Change (JC3) sector

• Work alongside financial institutions to strengthen industry capacity through the exchange

of knowledge, expertise, and best practices in managing climate-related risks

• Contribute to identifying key issues and priorities for the financial sector in navigating the

transition to a low-carbon economy

• Engage with stakeholders to advance coordinated and practical solutions to climate-

related challenges

• Actively involved in CCPT Implementation Group contributing to cross-industry alignment

and effective adoption of the taxonomy

• Led the CCPT Sub-Focus Group for SMEs in the publication of the SMEs Guidance Notes

covering six high-emitting carbon sectors

Community of Practitioners • Actively contribute to the development of the industry’s VBI scorecard, framework,

(CoP) of Bank Negara Malaysia’s guidelines and strategy

Value-Based Intermediation • Actively contribute to the enhancement of the industry’s VBI scorecard, framework,

(VBI) guidelines, and strategic direction

• Led the enhancement of the Energy Efficiency sectoral guidance paper, aligning with

national sustainability priorities and industry needs

General Council for Islamic • Actively support the advancement of Islamic finance on a global scale

Banks and Financial Institutions • Enhance the Bank’s commitment to ethical banking, financial inclusion, and sustainable

(CIBAFI) development, while fostering innovation and growth within the Islamic financial services

industry