Page 237 - Bank Muamalat_AR24

P. 237

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 235

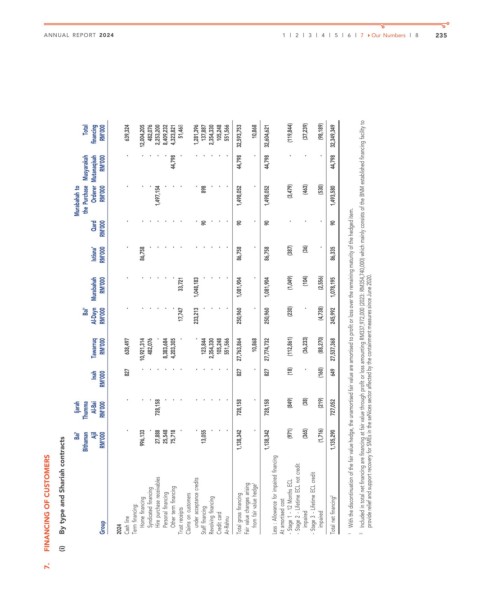

Total financing RM’000 639,324 12,004,205 482,076 2,253,200 8,409,232 4,323,821 51,468 1,281,396 137,887 2,354,330 105,248 551,566 32,593,753 10,868 32,604,621 (119,844) (37,239) (98,189) 32,349,349

Musyarakah Orderer Mutanaqisah RM’000 - - - - - 44,798 - - - - - - 44,798 - 44,798 - - - 44,798

to Purchase RM’000 - - - 1,497,154 - - - - 898 - - - 1,498,052 - 1,498,052 (3,479) (463) (530) 1,493,580

Murabahah the

Qard RM’000 - - - - - - - - 90 - - - 90 - 90 - - - 90

Istisna’ RM’000 - 86,758 - - - - - - - - - - 86,758 - 86,758 (387) (36) - 86,335

Murabahah RM’000 - - - - - - 33,721 1,048,183 - - - - 1,081,904 - 1,081,904 (1,049) (104) (2,556) 1,078,195

Al-Dayn 17,747 233,213 250,960 250,960 245,992 Included in total net financing are financing at fair value through profit or loss amounting RM337,972,000 (2023: RM354,740,000) which mainly consists of the BNM established financing facility to

Bai’ RM’000 - - - - - - - - - - - (230) - (4,738)

Tawarruq RM’000 638,497 10,921,314 482,076 - 8,383,684 4,203,305 - - 123,844 2,354,330 105,248 551,566 27,763,864 10,868 27,774,732 (112,861) (36,233) (88,270) 27,537,368

Inah RM’000 827 - - - - - - - - - - - 827 - 827 (18) - (160) 649 With the discontinuation of the fair value hedge, the unamortised fair value are amortised to profit or loss over the remaining maturity of the hedged item.

Ijarah Thumma Al-Bai RM’000 - - - 728,158 - - - - - - - - 728,158 - 728,158 (849) (38) (219) 727,052 provide relief and support recovery for SMEs in the seNices sector affected by the containment measures since June 2020.

Bai’ Bithaman Ajil RM’000 - 996,133 - 27,888 25,548 75,718 - - 13,055 - - - 1,138,342 - 1,138,342 (971) (365) (1,716) 1,135,290

FINANCING OF CUSTOMERS By type and Shariah contracts Group 2024 Cash line Term financing: Home financing Syndicated financing Hire purchase receivables Personal financing Other term financing Trust receipts Claims on customers under acceptance credits Staff financing Revolving financing Credit card Ar-Rahnu Total gross financing Fair value changes arising from fair value hedge 1 Less : Allowance for impaired fi

7. (i)