Page 238 - Bank Muamalat_AR24

P. 238

236 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

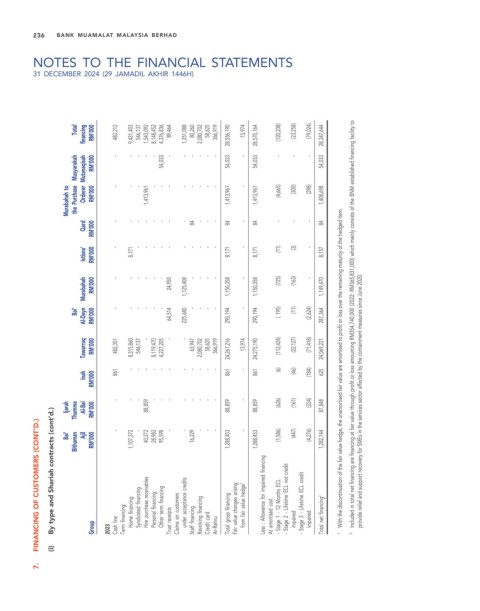

Total financing RM’000 483,212 9,431,403 546,137 1,543,092 8,148,452 4,376,836 89,464 1,351,088 80,260 2,080,702 58,625 366,919 28,556,190 13,974 28,570,164 (120,238) (23,258) (79,024) 28,347,644

Musyarakah Orderer Mutanaqisah RM’000 - - - - - 54,033 - - - - - - 54,033 - 54,033 - - - 54,033

to Purchase RM’000 - - - 1,413,961 - - - - - - - - 1,413,961 - 1,413,961 (4,665) (300) (298) 1,408,698

Murabahah the

Qard RM’000 - - - - - - - - 84 - - - 84 - 84 - - - 84

Istisna’ RM’000 - 8,171 - - - - - - - - - - 8,171 - 8,171 (11) (3) - 8,157

Murabahah RM’000 - - - - - - 24,950 1,125,408 - - - - 1,150,358 - 1,150,358 (725) (163) - 1,149,470

Al-Dayn 225,680 290,194 290,194 287,364 Included in total net financing are financing at fair value through profit or loss amounting RM354,740,000 (2022: RM365,831,000) which mainly consists of the BNM established financing facility to

Bai’ RM’000 - - - - - - 64,514 - - - - - ( 195) (11) (2,624)

Tawarruq RM’000 482,351 8,315,860 546,137 - 8,119,470 4,227,205 - - 63,947 2,080,702 58,625 366,919 24,261,216 13,974 24,275,190 (112,424) (22,127) (71,418) 24,069,221

Inah Thumma Al-Bai RM’000 RM’000 861 - - - - - - - 88,859 - - - - - - - - - - - - - - - - - - 861 88,859 - - 861 88,859 (6) (626) (46) (161) (184) (224) 625 87,848 With the discontinuation of the fair value hedge, the unamortised fair value are amortised to profit or loss over the remaining maturity of the hedged item. provide

Ijarah

FINANCING OF CUSTOMERS (CONT’D.) By type and Shariah contracts (cont’d.) Bai’ Bithaman Ajil RM’000 Cash line Term financing: 1,107,372 Home financing - Syndicated financing 40,272 Hire purchase receivables 28,982 Personal financing 95,598 Other term financing Trust receipts Claims on customers - under acceptance credits 16,229 Staff financing - Revolving financing - Credit card Ar-Rahnu 1,288,453 Total gross financing Fa

7. (i) Group 2023 1 2