Page 249 - Bank Muamalat_AR24

P. 249

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 247

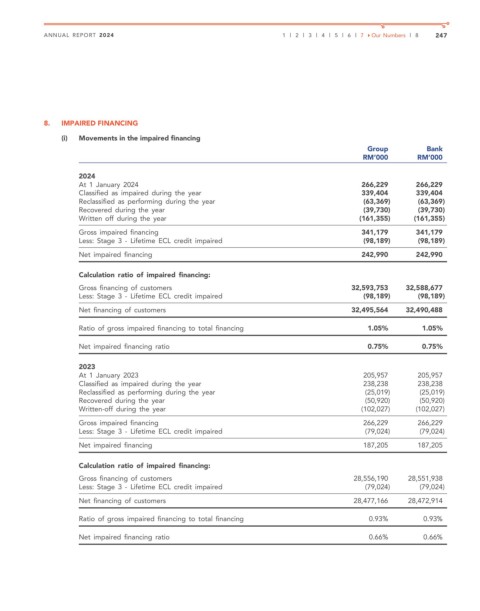

8. IMPAIRED FINANCING

(i) Movements in the impaired financing

Group Bank

RM’000 RM’000

2024

At 1 January 2024 266,229 266,229

Classified as impaired during the year 339,404 339,404

Reclassified as performing during the year (63,369) (63,369)

Recovered during the year (39,730) (39,730)

Written off during the year (161,355) (161,355)

Gross impaired financing 341,179 341,179

Less: Stage 3 - Lifetime ECL credit impaired (98,189) (98,189)

Net impaired financing 242,990 242,990

Calculation ratio of impaired financing:

Gross financing of customers 32,593,753 32,588,677

Less: Stage 3 - Lifetime ECL credit impaired (98,189) (98,189)

Net financing of customers 32,495,564 32,490,488

Ratio of gross impaired financing to total financing 1.05% 1.05%

Net impaired financing ratio 0.75% 0.75%

2023

At 1 January 2023 205,957 205,957

Classified as impaired during the year 238,238 238,238

Reclassified as performing during the year (25,019) (25,019)

Recovered during the year (50,920) (50,920)

Written-off during the year (102,027) (102,027)

Gross impaired financing 266,229 266,229

Less: Stage 3 - Lifetime ECL credit impaired (79,024) (79,024)

Net impaired financing 187,205 187,205

Calculation ratio of impaired financing:

Gross financing of customers 28,556,190 28,551,938

Less: Stage 3 - Lifetime ECL credit impaired (79,024) (79,024)

Net financing of customers 28,477,166 28,472,914

Ratio of gross impaired financing to total financing 0.93% 0.93%

Net impaired financing ratio 0.66% 0.66%