Page 253 - Bank Muamalat_AR24

P. 253

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 251

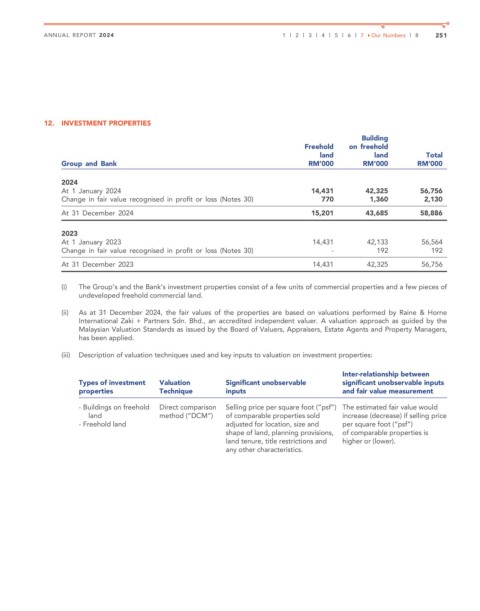

12. INVESTMENT PROPERTIES

Building

Freehold on freehold

land land Total

Group and Bank RM’000 RM’000 RM’000

2024

At 1 January 2024 14,431 42,325 56,756

Change in fair value recognised in profit or loss (Notes 30) 770 1,360 2,130

At 31 December 2024 15,201 43,685 58,886

2023

At 1 January 2023 14,431 42,133 56,564

Change in fair value recognised in profit or loss (Notes 30) - 192 192

At 31 December 2023 14,431 42,325 56,756

(i) The Group’s and the Bank’s investment properties consist of a few units of commercial properties and a few pieces of

undeveloped freehold commercial land.

(ii) As at 31 December 2024, the fair values of the properties are based on valuations performed by Raine & Horne

International Zaki + Partners Sdn. Bhd., an accredited independent valuer. A valuation approach as guided by the

Malaysian Valuation Standards as issued by the Board of Valuers, Appraisers, Estate Agents and Property Managers,

has been applied.

(iii) Description of valuation techniques used and key inputs to valuation on investment properties:

Inter-relationship between

Types of investment Valuation Significant unobservable significant unobservable inputs

properties Technique inputs and fair value measurement

- Buildings on freehold Direct comparison Selling price per square foot (“psf”) The estimated fair value would

land method (“DCM”) of comparable properties sold increase (decrease) if selling price

- Freehold land adjusted for location, size and per square foot (“psf”)

shape of land, planning provisions, of comparable properties is

land tenure, title restrictions and higher or (lower).

any other characteristics.