Page 254 - Bank Muamalat_AR24

P. 254

252 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

12. INVESTMENT PROPERTIES (CONT’D.)

(iv) Investment properties comprise a number of commercial properties that are leased to third parties. Each of the leases

contains an initial non-cancellable period of between 3-5 years. Subsequent renewals are negotiated with the lessee

and on average renewal periods are 3 years. The Group and the Bank does not charge variable lease payments that

do not depend on an index or rate.

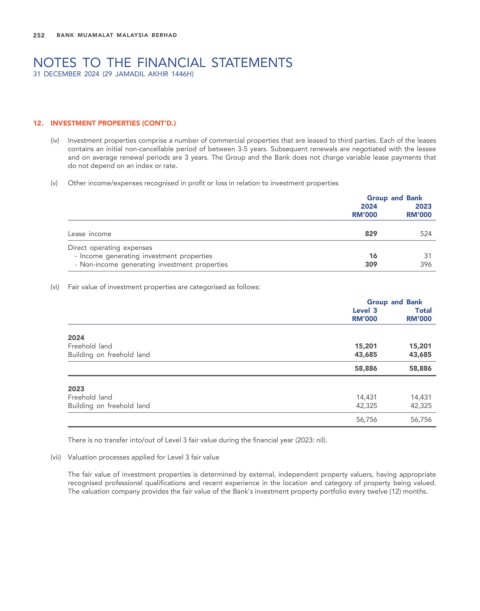

(v) Other income/expenses recognised in profit or loss in relation to investment properties

Group and Bank

2024 2023

RM’000 RM’000

Lease income 829 524

Direct operating expenses

- Income generating investment properties 16 31

- Non-income generating investment properties 309 396

(vi) Fair value of investment properties are categorised as follows:

Group and Bank

Level 3 Total

RM’000 RM’000

2024

Freehold land 15,201 15,201

Building on freehold land 43,685 43,685

58,886 58,886

2023

Freehold land 14,431 14,431

Building on freehold land 42,325 42,325

56,756 56,756

There is no transfer into/out of Level 3 fair value during the financial year (2023: nil).

(vii) Valuation processes applied for Level 3 fair value

The fair value of investment properties is determined by external, independent property valuers, having appropriate

recognised professional qualifications and recent experience in the location and category of property being valued.

The valuation company provides the fair value of the Bank’s investment property portfolio every twelve (12) months.