Page 309 - Bank Muamalat_AR24

P. 309

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 307

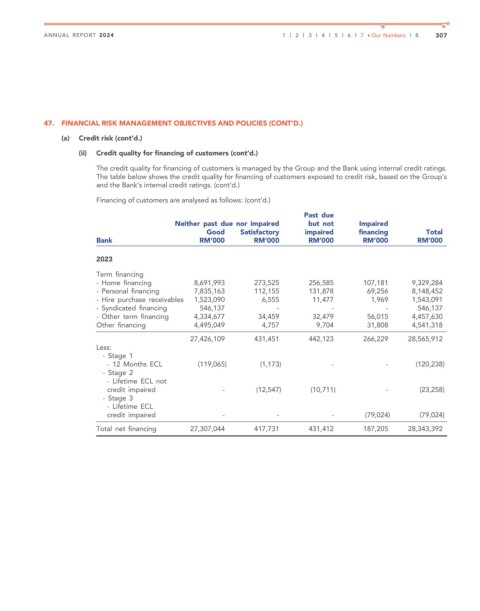

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(ii) Credit quality for financing of customers (cont’d.)

The credit quality for financing of customers is managed by the Group and the Bank using internal credit ratings.

The table below shows the credit quality for financing of customers exposed to credit risk, based on the Group’s

and the Bank’s internal credit ratings. (cont’d.)

Financing of customers are analysed as follows: (cont’d.)

Past due

Neither past due nor impaired but not Impaired

Good Satisfactory impaired financing Total

Bank RM’000 RM’000 RM’000 RM’000 RM’000

2023

Term financing

- Home financing 8,691,993 273,525 256,585 107,181 9,329,284

- Personal financing 7,835,163 112,155 131,878 69,256 8,148,452

- Hire purchase receivables 1,523,090 6,555 11,477 1,969 1,543,091

- Syndicated financing 546,137 - - - 546,137

- Other term financing 4,334,677 34,459 32,479 56,015 4,457,630

Other financing 4,495,049 4,757 9,704 31,808 4,541,318

27,426,109 431,451 442,123 266,229 28,565,912

Less:

- Stage 1

- 12 Months ECL (119,065) (1,173) - - (120,238)

- Stage 2

- Lifetime ECL not

credit impaired - (12,547) (10,711) - (23,258)

- Stage 3

- Lifetime ECL

credit impaired - - - (79,024) (79,024)

Total net financing 27,307,044 417,731 431,412 187,205 28,343,392