Page 308 - Bank Muamalat_AR24

P. 308

306 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

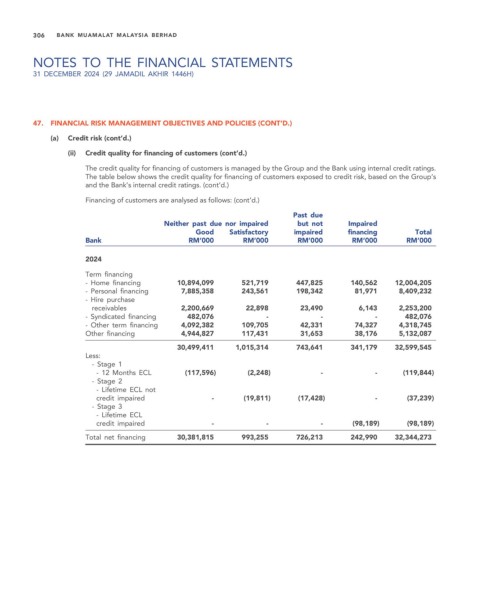

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(ii) Credit quality for financing of customers (cont’d.)

The credit quality for financing of customers is managed by the Group and the Bank using internal credit ratings.

The table below shows the credit quality for financing of customers exposed to credit risk, based on the Group’s

and the Bank’s internal credit ratings. (cont’d.)

Financing of customers are analysed as follows: (cont’d.)

Past due

Neither past due nor impaired but not Impaired

Good Satisfactory impaired financing Total

Bank RM’000 RM’000 RM’000 RM’000 RM’000

2024

Term financing

- Home financing 10,894,099 521,719 447,825 140,562 12,004,205

- Personal financing 7,885,358 243,561 198,342 81,971 8,409,232

- Hire purchase

receivables 2,200,669 22,898 23,490 6,143 2,253,200

- Syndicated financing 482,076 - - - 482,076

- Other term financing 4,092,382 109,705 42,331 74,327 4,318,745

Other financing 4,944,827 117,431 31,653 38,176 5,132,087

30,499,411 1,015,314 743,641 341,179 32,599,545

Less:

- Stage 1

- 12 Months ECL (117,596) (2,248) - - (119,844)

- Stage 2

- Lifetime ECL not

credit impaired - (19,811) (17,428) - (37,239)

- Stage 3

- Lifetime ECL

credit impaired - - - (98,189) (98,189)

Total net financing 30,381,815 993,255 726,213 242,990 32,344,273