Page 318 - Bank Muamalat_AR24

P. 318

316 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

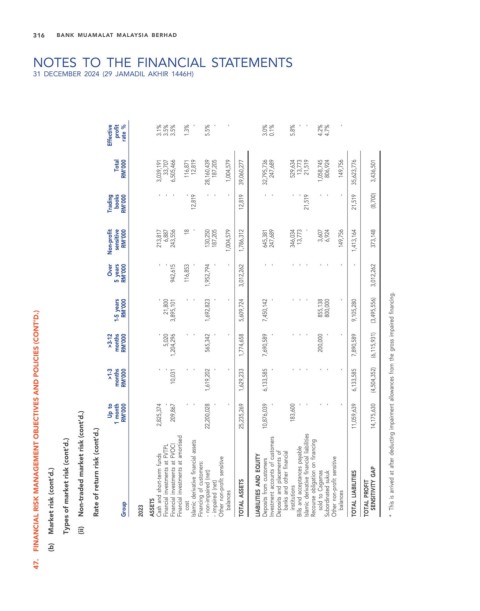

Effective profit rate % 3.1% 3.5% 3.5% 1.3% - 5.5% - - 3.0% 0.1% 5.8% - - 4.2% 4.7% -

Total RM’000 3,039,191 33,707 6,505,466 116,871 12,819 28,160,439 187,205 1,004,579 39,060,277 32,795,736 247,689 529,634 13,773 21,519 1,058,745 806,924 149,756 35,623,776 3,436,501

Trading books RM’000 - - - - 12,819 - - - 12,819 - - - - 21,519 - - - 21,519 (8,700)

Non-profit sensitive RM’000 213,817 6,887 243,556 18 - 130,250 187,205 1,004,579 1,786,312 645,381 247,689 346,034 13,773 - 3,607 6,924 149,756 1,413,164 373,148

Over 5 years RM’000 - - 942,615 116,853 - 1,952,794 - - 3,012,262 - - - - - - - - - 3,012,262

1-5 years RM’000 21,800 3,895,101 1,692,823 5,609,724 7,450,142 855,138 800,000 9,105,280 (3,495,556)

- - - - - - - - - -

FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

>3-12 months RM’000 - 5,020 1,204,296 - - 565,342 - - 1,774,658 7,690,589 - - - - 200,000 - - 7,890,589 (6,115,931)

>1-3 months RM’000 - - 10,031 - - 1,619,202 - - 1,629,233 6,133,585 - - - - - - - 6,133,585 (4,504,352)

Up to 1 month RM’000 2,825,374 - 209,867 - - assets 22,200,028 - - 25,235,269 10,876,039 - 183,600 - - liabilities - - - 11,059,639 14,175,630 This is arrived at after deducting impairment allowances from the gross impaired financing.

Market risk (cont’d.) Types of market risk (cont’d.) Non-traded market risk (cont’d.) Rate of return risk (cont’d.) Group 2023 ASSETS Cash and short-term funds Financial investments at FVTPL Financial investments at FVOCI Financial investments at amortised cost financial derivative Islamic Financing of customers: - non-impaired (net) (net) impaired - Other non-profit sensitive balances TOTAL ASSETS LIABILITIES AND EQUITY Deposits from

(b) (ii)

47.