Page 322 - Bank Muamalat_AR24

P. 322

320 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(b) Market risk (cont’d.)

Types of market risk (cont’d.)

(ii) Non-traded market risk (cont’d.)

Rate of return risk (cont’d.)

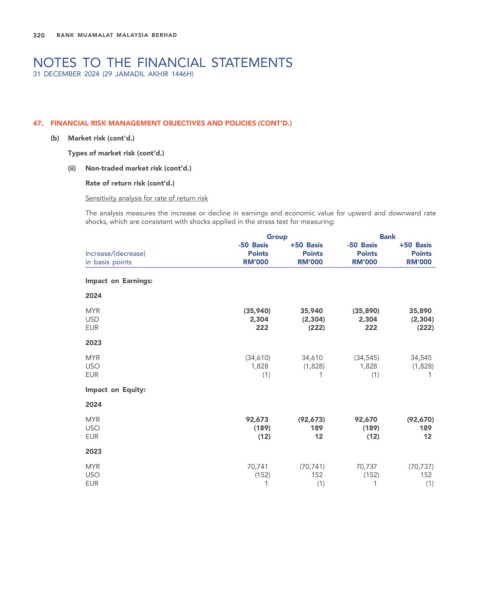

Sensitivity analysis for rate of return risk

The analysis measures the increase or decline in earnings and economic value for upward and downward rate

shocks, which are consistent with shocks applied in the stress test for measuring:

Group Bank

-50 Basis +50 Basis -50 Basis +50 Basis

Increase/(decrease) Points Points Points Points

in basis points RM’000 RM’000 RM’000 RM’000

Impact on Earnings:

2024

MYR (35,940) 35,940 (35,890) 35,890

USD 2,304 (2,304) 2,304 (2,304)

EUR 222 (222) 222 (222)

2023

MYR (34,610) 34,610 (34,545) 34,545

USO 1,828 (1,828) 1,828 (1,828)

EUR (1) 1 (1) 1

Impact on Equity:

2024

MYR 92,673 (92,673) 92,670 (92,670)

USO (189) 189 (189) 189

EUR (12) 12 (12) 12

2023

MYR 70,741 (70,741) 70,737 (70,737)

USO (152) 152 (152) 152

EUR 1 (1) 1 (1)