Page 338 - Bank Muamalat_AR24

P. 338

336 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

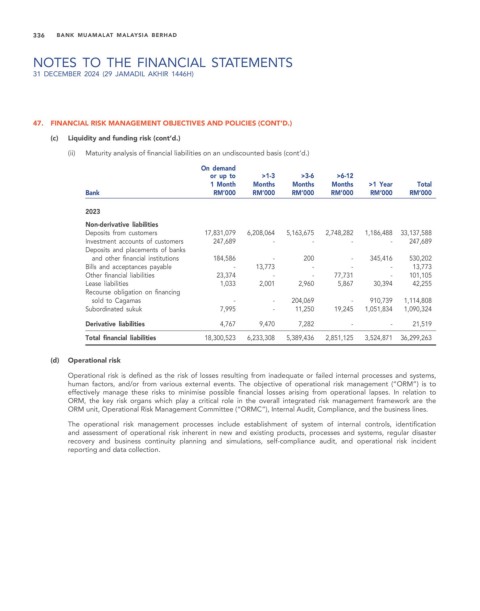

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(c) Liquidity and funding risk (cont’d.)

(ii) Maturity analysis of financial liabilities on an undiscounted basis (cont’d.)

On demand

or up to >1-3 >3-6 >6-12

1 Month Months Months Months >1 Year Total

Bank RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2023

Non-derivative liabilities

Deposits from customers 17,831,079 6,208,064 5,163,675 2,748,282 1,186,488 33,137,588

Investment accounts of customers 247,689 - - - - 247,689

Deposits and placements of banks

and other financial institutions 184,586 - 200 - 345,416 530,202

Bills and acceptances payable - 13,773 - - - 13,773

Other financial liabilities 23,374 - - 77,731 - 101,105

Lease liabilities 1,033 2,001 2,960 5,867 30,394 42,255

Recourse obligation on financing

sold to Cagamas - - 204,069 - 910,739 1,114,808

Subordinated sukuk 7,995 - 11,250 19,245 1,051,834 1,090,324

Derivative liabilities 4,767 9,470 7,282 - - 21,519

Total financial liabilities 18,300,523 6,233,308 5,389,436 2,851,125 3,524,871 36,299,263

(d) Operational risk

Operational risk is defined as the risk of losses resulting from inadequate or failed internal processes and systems,

human factors, and/or from various external events. The objective of operational risk management (“ORM”) is to

effectively manage these risks to minimise possible financial losses arising from operational lapses. In relation to

ORM, the key risk organs which play a critical role in the overall integrated risk management framework are the

ORM unit, Operational Risk Management Committee (“ORMC”), Internal Audit, Compliance, and the business lines.

The operational risk management processes include establishment of system of internal controls, identification

and assessment of operational risk inherent in new and existing products, processes and systems, regular disaster

recovery and business continuity planning and simulations, self-compliance audit, and operational risk incident

reporting and data collection.