Page 340 - Bank Muamalat_AR24

P. 340

338 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

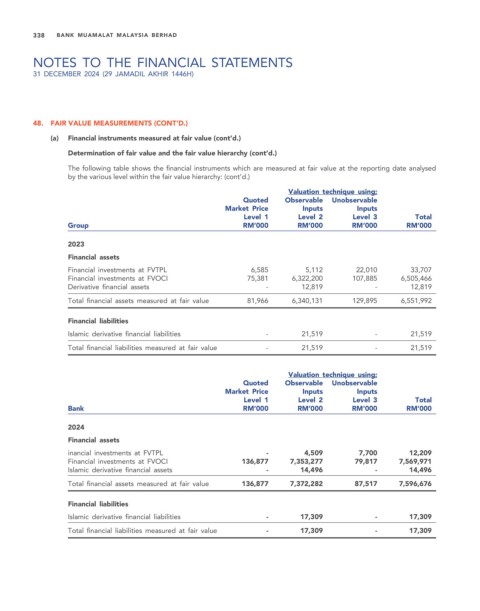

48. FAIR VALUE MEASUREMENTS (CONT’D.)

(a) Financial instruments measured at fair value (cont’d.)

Determination of fair value and the fair value hierarchy (cont’d.)

The following table shows the financial instruments which are measured at fair value at the reporting date analysed

by the various level within the fair value hierarchy: (cont’d.)

Valuation technique using;

Quoted Observable Unobservable

Market Price Inputs Inputs

Level 1 Level 2 Level 3 Total

Group RM’000 RM’000 RM’000 RM’000

2023

Financial assets

Financial investments at FVTPL 6,585 5,112 22,010 33,707

Financial investments at FVOCI 75,381 6,322,200 107,885 6,505,466

Derivative financial assets - 12,819 - 12,819

Total financial assets measured at fair value 81,966 6,340,131 129,895 6,551,992

Financial liabilities

Islamic derivative financial liabilities - 21,519 - 21,519

Total financial liabilities measured at fair value - 21,519 - 21,519

Valuation technique using;

Quoted Observable Unobservable

Market Price Inputs Inputs

Level 1 Level 2 Level 3 Total

Bank RM’000 RM’000 RM’000 RM’000

2024

Financial assets

inancial investments at FVTPL - 4,509 7,700 12,209

Financial investments at FVOCI 136,877 7,353,277 79,817 7,569,971

Islamic derivative financial assets - 14,496 - 14,496

Total financial assets measured at fair value 136,877 7,372,282 87,517 7,596,676

Financial liabilities

Islamic derivative financial liabilities - 17,309 - 17,309

Total financial liabilities measured at fair value - 17,309 - 17,309