Page 361 - Bank Muamalat_AR24

P. 361

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 359

2.1 INTERNAL CAPITAL ADEQUACY ASSESSMENT PROCESS (“ICAAP”) (CONT’D)

Stress Test

Stress testing is an important tool used in assessing and determining appropriateness of capital levels to ensure its ability

to absorb stress events in order to protect the depositors and other stakeholders.

Stress testing is performed to identify early warning signs and potential risk events that may adversely impact the

Bank’s risk profile. Stress testing is also used to determine the level of capital buffers that are considered adequate

to ensure that the Bank does not breach the minimum regulatory ratios under stress scenarios and to formulate

appropriate management actions.

The Bank employs two stress test approaches, namely sensitivity and scenario analyses. The stress testing supports

management and decision making in the following areas:

i. Assessment of the Bank’s material risk profile under stress events and estimate the potential impact and implications

to the Bank;

ii. Assessment of capital adequacy in relation to the Bank’s risk profile, which is integral to the ICAAP;

iii. Facilitate capital and liquidity contingency planning across a range of stressed conditions and aiding in the

development and formulation of appropriate strategies for maintaining required level of capital and management

of identified risks; and

iv. Embedded as an integral part of the strategic planning and management process.

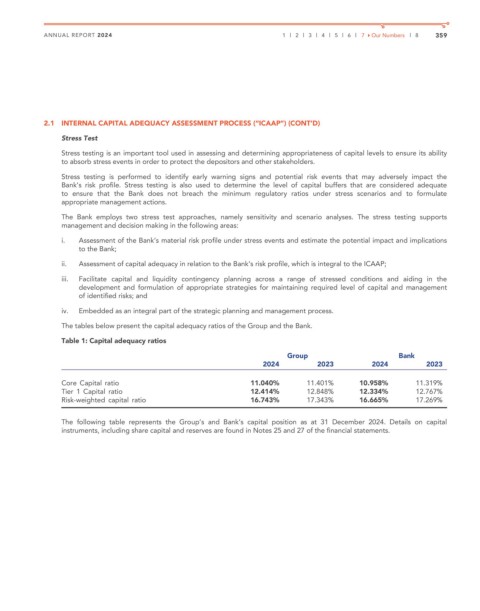

The tables below present the capital adequacy ratios of the Group and the Bank.

Table 1: Capital adequacy ratios

Group Bank

2024 2023 2024 2023

Core Capital ratio 11.040% 11.401% 10.958% 11.319%

Tier 1 Capital ratio 12.414% 12.848% 12.334% 12.767%

Risk-weighted capital ratio 16.743% 17.343% 16.665% 17.269%

The following table represents the Group’s and Bank’s capital position as at 31 December 2024. Details on capital

instruments, including share capital and reserves are found in Notes 25 and 27 of the financial statements.