Page 364 - Bank Muamalat_AR24

P. 364

362 BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

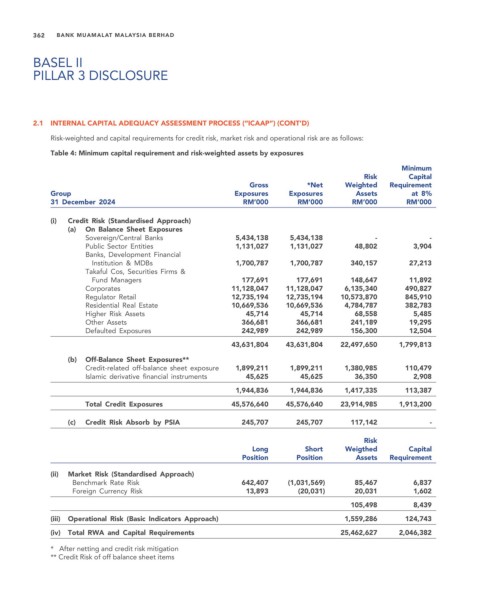

2.1 INTERNAL CAPITAL ADEQUACY ASSESSMENT PROCESS (“ICAAP”) (CONT’D)

Risk-weighted and capital requirements for credit risk, market risk and operational risk are as follows:

Table 4: Minimum capital requirement and risk-weighted assets by exposures

Minimum

Risk Capital

Gross *Net Weighted Requirement

Group Exposures Exposures Assets at 8%

31 December 2024 RM’000 RM’000 RM’000 RM’000

(i) Credit Risk (Standardised Approach)

(a) On Balance Sheet Exposures

Sovereign/Central Banks 5,434,138 5,434,138 - -

Public Sector Entities 1,131,027 1,131,027 48,802 3,904

Banks, Development Financial

Institution & MDBs 1,700,787 1,700,787 340,157 27,213

Takaful Cos, Securities Firms &

Fund Managers 177,691 177,691 148,647 11,892

Corporates 11,128,047 11,128,047 6,135,340 490,827

Regulator Retail 12,735,194 12,735,194 10,573,870 845,910

Residential Real Estate 10,669,536 10,669,536 4,784,787 382,783

Higher Risk Assets 45,714 45,714 68,558 5,485

Other Assets 366,681 366,681 241,189 19,295

Defaulted Exposures 242,989 242,989 156,300 12,504

43,631,804 43,631,804 22,497,650 1,799,813

(b) Off-Balance Sheet Exposures**

Credit-related off-balance sheet exposure 1,899,211 1,899,211 1,380,985 110,479

Islamic derivative financial instruments 45,625 45,625 36,350 2,908

1,944,836 1,944,836 1,417,335 113,387

Total Credit Exposures 45,576,640 45,576,640 23,914,985 1,913,200

(c) Credit Risk Absorb by PSIA 245,707 245,707 117,142 -

Risk

Long Short Weigthed Capital

Position Position Assets Requirement

(ii) Market Risk (Standardised Approach)

Benchmark Rate Risk 642,407 (1,031,569) 85,467 6,837

Foreign Currency Risk 13,893 (20,031) 20,031 1,602

105,498 8,439

(iii) Operational Risk (Basic Indicators Approach) 1,559,286 124,743

(iv) Total RWA and Capital Requirements 25,462,627 2,046,382

* After netting and credit risk mitigation

** Credit Risk of off balance sheet items