Page 362 - Bank Muamalat_AR24

P. 362

360 BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

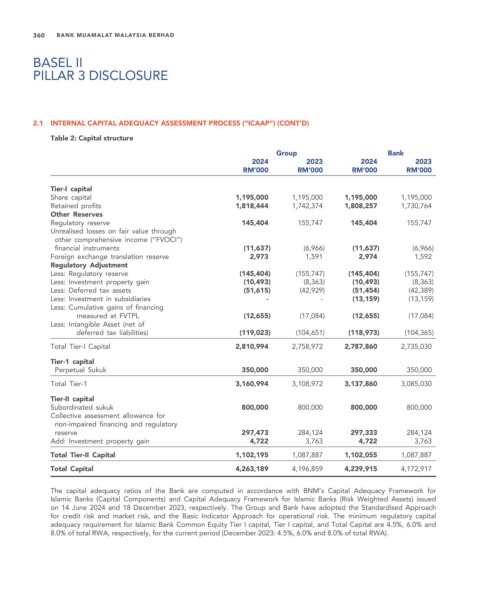

2.1 INTERNAL CAPITAL ADEQUACY ASSESSMENT PROCESS (“ICAAP”) (CONT’D)

Table 2: Capital structure

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

Tier-I capital

Share capital 1,195,000 1,195,000 1,195,000 1,195,000

Retained profits 1,818,444 1,742,374 1,808,257 1,730,764

Other Reserves

Regulatory reserve 145,404 155,747 145,404 155,747

Unrealised losses on fair value through

other comprehensive income (“FVOCI”)

financial instruments (11,637) (6,966) (11,637) (6,966)

Foreign exchange translation reserve 2,973 1,591 2,974 1,592

Regulatory Adjustment

Less: Regulatory reserve (145,404) (155,747) (145,404) (155,747)

Less: Investment property gain (10,493) (8,363) (10,493) (8,363)

Less: Deferred tax assets (51,615) (42,929) (51,454) (42,389)

Less: Investment in subsidiaries - - (13,159) (13,159)

Less: Cumulative gains of financing

measured at FVTPL (12,655) (17,084) (12,655) (17,084)

Less: Intangible Asset (net of

deferred tax liabilities) (119,023) (104,651) (118,973) (104,365)

Total Tier-I Capital 2,810,994 2,758,972 2,787,860 2,735,030

Tier-1 capital

Perpetual Sukuk 350,000 350,000 350,000 350,000

Total Tier-1 3,160,994 3,108,972 3,137,860 3,085,030

Tier-II capital

Subordinated sukuk 800,000 800,000 800,000 800,000

Collective assessment allowance for

non-impaired financing and regulatory

reserve 297,473 284,124 297,333 284,124

Add: Investment property gain 4,722 3,763 4,722 3,763

Total Tier-II Capital 1,102,195 1,087,887 1,102,055 1,087,887

Total Capital 4,263,189 4,196,859 4,239,915 4,172,917

The capital adequacy ratios of the Bank are computed in accordance with BNM’s Capital Adequacy Framework for

Islamic Banks (Capital Components) and Capital Adequacy Framework for Islamic Banks (Risk Weighted Assets) issued

on 14 June 2024 and 18 December 2023, respectively. The Group and Bank have adopted the Standardised Approach

for credit risk and market risk, and the Basic Indicator Approach for operational risk. The minimum regulatory capital

adequacy requirement for Islamic Bank Common Equity Tier I capital, Tier I capital, and Total Capital are 4.5%, 6.0% and

8.0% of total RWA, respectively, for the current period (December 2023: 4.5%, 6.0% and 8.0% of total RWA).