Page 372 - Bank Muamalat_AR24

P. 372

370 BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

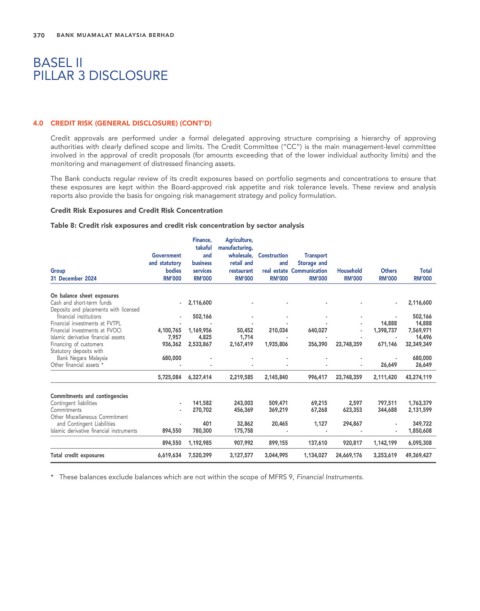

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

Credit approvals are performed under a formal delegated approving structure comprising a hierarchy of approving

authorities with clearly defined scope and limits. The Credit Committee (“CC”) is the main management-level committee

involved in the approval of credit proposals (for amounts exceeding that of the lower individual authority limits) and the

monitoring and management of distressed financing assets.

The Bank conducts regular review of its credit exposures based on portfolio segments and concentrations to ensure that

these exposures are kept within the Board-approved risk appetite and risk tolerance levels. These review and analysis

reports also provide the basis for ongoing risk management strategy and policy formulation.

Credit Risk Exposures and Credit Risk Concentration

Table 8: Credit risk exposures and credit risk concentration by sector analysis

Finance, Agriculture,

takaful manufacturing,

Government and wholesale, Construction Transport

and statutory business retail and and Storage and

Group bodies services restaurant real estate Communication Household Others Total

31 December 2024 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

On balance sheet exposures

Cash and short-term funds - 2,116,600 - - - - - 2,116,600

Deposits and placements with licensed

financial institutions - 502,166 - - - - - 502,166

Financial investments at FVTPL - - - - - - 14,888 14,888

Financial investments at FVOCI 4,100,765 1,169,956 50,452 210,034 640,027 - 1,398,737 7,569,971

Islamic derivative financial assets 7,957 4,825 1,714 - - - - 14,496

Financing of customers 936,362 2,533,867 2,167,419 1,935,806 356,390 23,748,359 671,146 32,349,349

Statutory deposits with

Bank Negara Malaysia 680,000 - - - - - - 680,000

Other financial assets * - - - - - - 26,649 26,649

5,725,084 6,327,414 2,219,585 2,145,840 996,417 23,748,359 2,111,420 43,274,119

Commitments and contingencies

Contingent liabilities - 141,582 243,003 509,471 69,215 2,597 797,511 1,763,379

Commitments - 270,702 456,369 369,219 67,268 623,353 344,688 2,131,599

Other Miscellaneous Commitment

and Contingent Liabilities - 401 32,862 20,465 1,127 294,867 - 349,722

Islamic derivative financial instruments 894,550 780,300 175,758 - - - - 1,850,608

894,550 1,192,985 907,992 899,155 137,610 920,817 1,142,199 6,095,308

Total credit exposures 6,619,634 7,520,399 3,127,577 3,044,995 1,134,027 24,669,176 3,253,619 49,369,427

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.