Page 375 - Bank Muamalat_AR24

P. 375

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 373

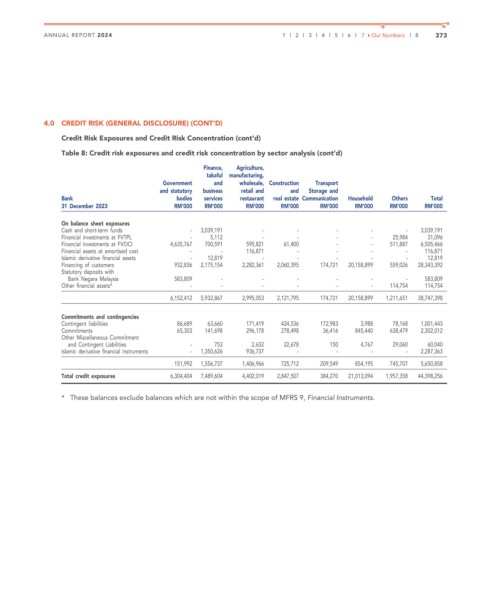

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

Credit Risk Exposures and Credit Risk Concentration (cont’d)

Table 8: Credit risk exposures and credit risk concentration by sector analysis (cont’d)

Finance, Agriculture,

takaful manufacturing,

Government and wholesale, Construction Transport

and statutory business retail and and Storage and

Bank bodies services restaurant real estate Communication Household Others Total

31 December 2023 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

On balance sheet exposures

Cash and short-term funds - 3,039,191 - - - - - 3,039,191

Financial investments at FVTPL - 5,112 - - - - 25,984 31,096

Financial investments at FVOCI 4,635,767 700,591 595,821 61,400 - - 511,887 6,505,466

Financial assets at amortised cost - - 116,871 - - - - 116,871

Islamic derivative financial assets - 12,819 - - - - - 12,819

Financing of customers 932,836 2,175,154 2,282,361 2,060,395 174,721 20,158,899 559,026 28,343,392

Statutory deposits with

Bank Negara Malaysia 583,809 - - - - - - 583,809

Other financial assets* - - - - - - 114,754 114,754

6,152,412 5,932,867 2,995,053 2,121,795 174,721 20,158,899 1,211,651 38,747,398

Commitments and contingencies

Contingent liabilities 86,689 63,660 171,419 424,536 172,983 3,988 78,168 1,001,443

Commitments 65,303 141,698 296,178 278,498 36,416 845,440 638,479 2,302,012

Other Miscellaneous Commitment

and Contingent Liabilities - 753 2,632 22,678 150 4,767 29,060 60,040

Islamic derivative financial instruments - 1,350,626 936,737 - - - - 2,287,363

151,992 1,556,737 1,406,966 725,712 209,549 854,195 745,707 5,650,858

Total credit exposures 6,304,404 7,489,604 4,402,019 2,847,507 384,270 21,013,094 1,957,358 44,398,256

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.