Page 386 - Bank Muamalat_AR24

P. 386

384 BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

Credit Quality Financing of Customers (cont’d)

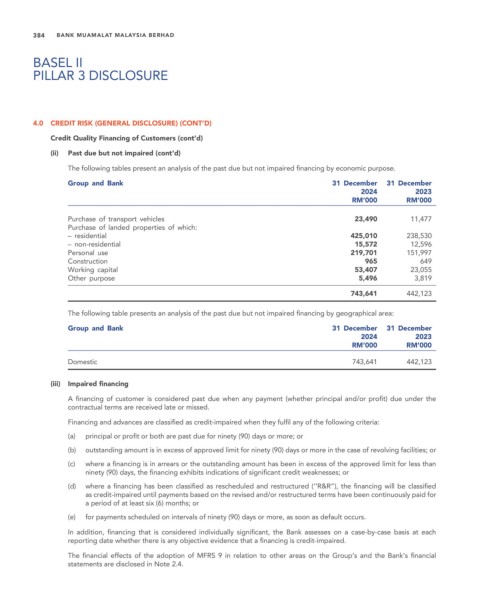

(ii) Past due but not impaired (cont’d)

The following tables present an analysis of the past due but not impaired financing by economic purpose.

Group and Bank 31 December 31 December

2024 2023

RM’000 RM’000

Purchase of transport vehicles 23,490 11,477

Purchase of landed properties of which:

– residential 425,010 238,530

– non-residential 15,572 12,596

Personal use 219,701 151,997

Construction 965 649

Working capital 53,407 23,055

Other purpose 5,496 3,819

743,641 442,123

The following table presents an analysis of the past due but not impaired financing by geographical area:

Group and Bank 31 December 31 December

2024 2023

RM’000 RM’000

Domestic 743,641 442,123

(iii) Impaired financing

A financing of customer is considered past due when any payment (whether principal and/or profit) due under the

contractual terms are received late or missed.

Financing and advances are classified as credit-impaired when they fulfil any of the following criteria:

(a) principal or profit or both are past due for ninety (90) days or more; or

(b) outstanding amount is in excess of approved limit for ninety (90) days or more in the case of revolving facilities; or

(c) where a financing is in arrears or the outstanding amount has been in excess of the approved limit for less than

ninety (90) days, the financing exhibits indications of significant credit weaknesses; or

(d) where a financing has been classified as rescheduled and restructured (‘’R&R”), the financing will be classified

as credit-impaired until payments based on the revised and/or restructured terms have been continuously paid for

a period of at least six (6) months; or

(e) for payments scheduled on intervals of ninety (90) days or more, as soon as default occurs.

In addition, financing that is considered individually significant, the Bank assesses on a case-by-case basis at each

reporting date whether there is any objective evidence that a financing is credit-impaired.

The financial effects of the adoption of MFRS 9 in relation to other areas on the Group’s and the Bank’s financial

statements are disclosed in Note 2.4.