Page 384 - Bank Muamalat_AR24

P. 384

382 BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

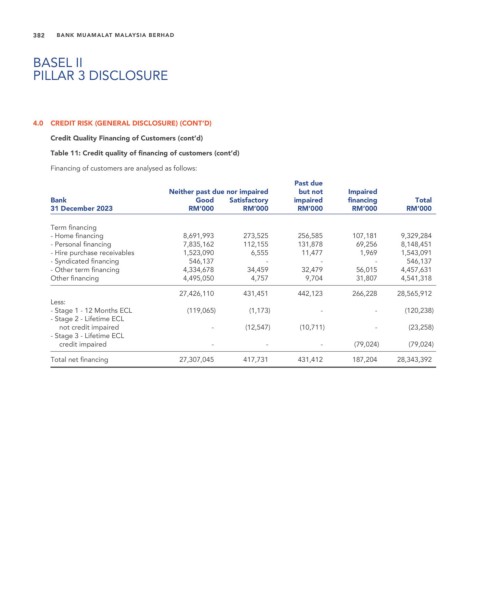

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

Credit Quality Financing of Customers (cont’d)

Table 11: Credit quality of financing of customers (cont’d)

Financing of customers are analysed as follows:

Past due

Neither past due nor impaired but not Impaired

Bank Good Satisfactory impaired financing Total

31 December 2023 RM’000 RM’000 RM’000 RM’000 RM’000

Term financing

- Home financing 8,691,993 273,525 256,585 107,181 9,329,284

- Personal financing 7,835,162 112,155 131,878 69,256 8,148,451

- Hire purchase receivables 1,523,090 6,555 11,477 1,969 1,543,091

- Syndicated financing 546,137 - - - 546,137

- Other term financing 4,334,678 34,459 32,479 56,015 4,457,631

Other financing 4,495,050 4,757 9,704 31,807 4,541,318

27,426,110 431,451 442,123 266,228 28,565,912

Less:

- Stage 1 - 12 Months ECL (119,065) (1,173) - - (120,238)

- Stage 2 - Lifetime ECL

not credit impaired - (12,547) (10,711) - (23,258)

- Stage 3 - Lifetime ECL

credit impaired - - - (79,024) (79,024)

Total net financing 27,307,045 417,731 431,412 187,204 28,343,392