Page 41 - Bank Muamalat_AR24

P. 41

ANNUAL REPORT 2024 1 2 3 Our Strategy 4 5 6 7 8 39

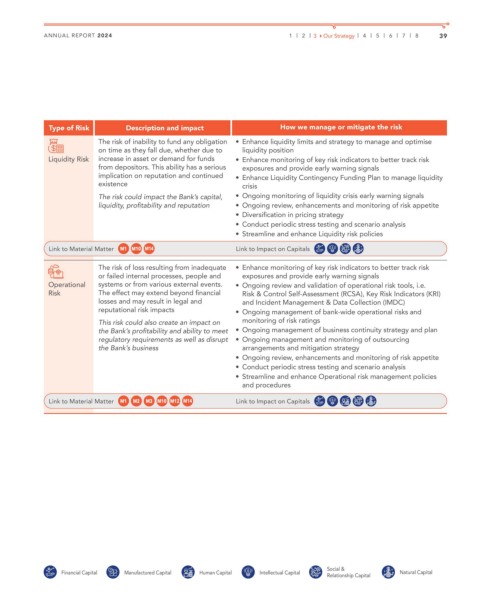

Type of Risk Description and impact How we manage or mitigate the risk

The risk of inability to fund any obligation • Enhance liquidity limits and strategy to manage and optimise

on time as they fall due, whether due to liquidity position

Liquidity Risk increase in asset or demand for funds • Enhance monitoring of key risk indicators to better track risk

from depositors. This ability has a serious exposures and provide early warning signals

implication on reputation and continued • Enhance Liquidity Contingency Funding Plan to manage liquidity

existence crisis

The risk could impact the Bank’s capital, • Ongoing monitoring of liquidity crisis early warning signals

liquidity, profitability and reputation • Ongoing review, enhancements and monitoring of risk appetite

• Diversification in pricing strategy

• Conduct periodic stress testing and scenario analysis

• Streamline and enhance Liquidity risk policies

Link to Material Matter Link to Impact on Capitals

The risk of loss resulting from inadequate • Enhance monitoring of key risk indicators to better track risk

or failed internal processes, people and exposures and provide early warning signals

Operational systems or from various external events. • Ongoing review and validation of operational risk tools, i.e.

Risk The effect may extend beyond financial Risk & Control Self-Assessment (RCSA), Key Risk Indicators (KRI)

losses and may result in legal and and Incident Management & Data Collection (IMDC)

reputational risk impacts • Ongoing management of bank-wide operational risks and

This risk could also create an impact on monitoring of risk ratings

the Bank’s profitability and ability to meet • Ongoing management of business continuity strategy and plan

regulatory requirements as well as disrupt • Ongoing management and monitoring of outsourcing

the Bank’s business arrangements and mitigation strategy

• Ongoing review, enhancements and monitoring of risk appetite

• Conduct periodic stress testing and scenario analysis

• Streamline and enhance Operational risk management policies

and procedures

Link to Material Matter Link to Impact on Capitals

Social &

Financial Capital Manufactured Capital Human Capital Intellectual Capital Relationship Capital Natural Capital