Page 43 - Bank Muamalat_AR24

P. 43

ANNUAL REPORT 2024 1 2 3 Our Strategy 4 5 6 7 8 41

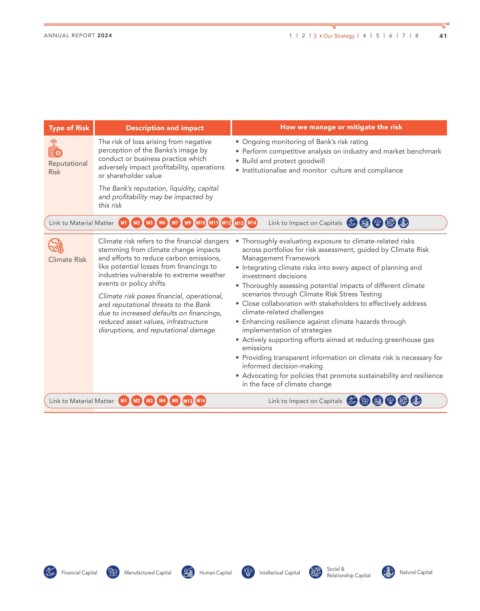

Type of Risk Description and impact How we manage or mitigate the risk

The risk of loss arising from negative • Ongoing monitoring of Bank’s risk rating

perception of the Banks’s image by • Perform competitive analysis on industry and market benchmark

conduct or business practice which • Build and protect goodwill

Reputational adversely impact profitability, operations

Risk • Institutionalise and monitor culture and compliance

or shareholder value

The Bank’s reputation, liquidity, capital

and profitability may be impacted by

this risk

Link to Material Matter Link to Impact on Capitals

Climate risk refers to the financial dangers • Thoroughly evaluating exposure to climate-related risks

stemming from climate change impacts across portfolios for risk assessment, guided by Climate Risk

Climate Risk and efforts to reduce carbon emissions, Management Framework

like potential losses from financings to • Integrating climate risks into every aspect of planning and

industries vulnerable to extreme weather investment decisions

events or policy shifts • Thoroughly assessing potential impacts of different climate

Climate risk poses financial, operational, scenarios through Climate Risk Stress Testing

and reputational threats to the Bank • Close collaboration with stakeholders to effectively address

due to increased defaults on financings, climate-related challenges

reduced asset values, infrastructure • Enhancing resilience against climate hazards through

disruptions, and reputational damage implementation of strategies

• Actively supporting efforts aimed at reducing greenhouse gas

emissions

• Providing transparent information on climate risk is necessary for

informed decision-making

• Advocating for policies that promote sustainability and resilience

in the face of climate change

Link to Material Matter Link to Impact on Capitals

Social &

Financial Capital Manufactured Capital Human Capital Intellectual Capital Relationship Capital Natural Capital