Page 69 - Bank Muamalat_AR24

P. 69

ANNUAL REPORT 2024 1 2 3 4 Our Business Performance 5 6 7 8 67

TRANSACTION BANKING AND RETAIL DEPOSIT

The Transaction Banking Division (TBD) at Bank Muamalat

Total Deposits specialises in managing both Retail and Non-Retail products

RM36.5 billion and services, with a primary focus on driving deposit growth

(11.2% YoY) for the Bank. It provides customised Cash Management

Solutions designed to meet the needs of businesses,

corporate clients, and government entities. The division’s

comprehensive offerings include Account Management, Payments, Liquidity Management,

Collections, Electronic Banking, Remittance, and more. In FY2024, TBD demonstrated

substantial growth in its deposit portfolio, successfully navigating a highly competitive

market landscape with a proactive and adaptable approach to maintaining growth and

market relevance in the dynamic financial services landscape.

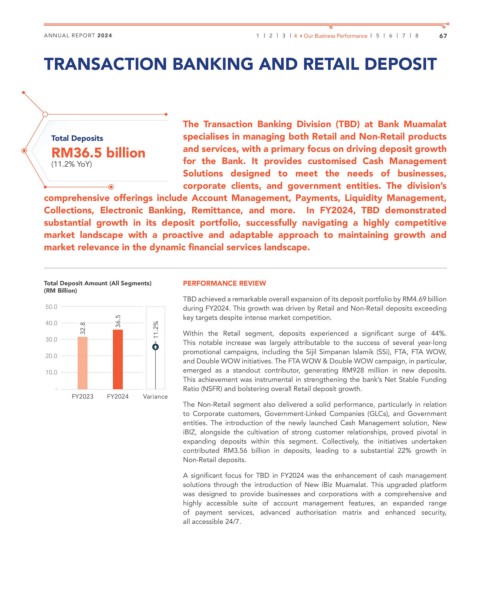

Total Deposit Amount (All Segments) PERFORMANCE REVIEW

(RM Billion)

TBD achieved a remarkable overall expansion of its deposit portfolio by RM4.69 billion

50.0 during FY2024. This growth was driven by Retail and Non-Retail deposits exceeding

40.0 36.5 key targets despite intense market competition.

32.8 11.2% Within the Retail segment, deposits experienced a significant surge of 44%.

30.0 This notable increase was largely attributable to the success of several year-long

promotional campaigns, including the Sijil Simpanan Islamik (SSi), FTA, FTA WOW,

20.0

and Double WOW initiatives. The FTA WOW & Double WOW campaign, in particular,

10.0 emerged as a standout contributor, generating RM928 million in new deposits.

This achievement was instrumental in strengthening the bank’s Net Stable Funding

- Ratio (NSFR) and bolstering overall Retail deposit growth.

FY2023 FY2024 Variance

The Non-Retail segment also delivered a solid performance, particularly in relation

to Corporate customers, Government-Linked Companies (GLCs), and Government

entities. The introduction of the newly launched Cash Management solution, New

iBIZ, alongside the cultivation of strong customer relationships, proved pivotal in

expanding deposits within this segment. Collectively, the initiatives undertaken

contributed RM3.56 billion in deposits, leading to a substantial 22% growth in

Non-Retail deposits.

A significant focus for TBD in FY2024 was the enhancement of cash management

solutions through the introduction of New iBiz Muamalat. This upgraded platform

was designed to provide businesses and corporations with a comprehensive and

highly accessible suite of account management features, an expanded range

of payment services, advanced authorisation matrix and enhanced security,

all accessible 24/7.