Page 70 - Bank Muamalat_AR24

P. 70

68 BANK MUAMALAT MALAYSIA BERHAD

TRANSACTION BANKING AND RETAIL DEPOSIT

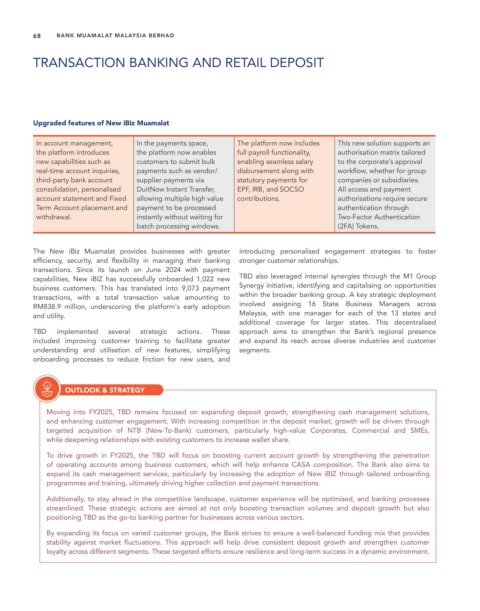

Upgraded features of New iBiz Muamalat

In account management, In the payments space, The platform now includes This new solution supports an

the platform introduces the platform now enables full payroll functionality, authorisation matrix tailored

new capabilities such as customers to submit bulk enabling seamless salary to the corporate’s approval

real-time account inquiries, payments such as vendor/ disbursement along with workflow, whether for group

third-party bank account supplier payments via statutory payments for companies or subsidiaries.

consolidation, personalised DuitNow Instant Transfer, EPF, IRB, and SOCSO All access and payment

account statement and Fixed allowing multiple high value contributions. authorisations require secure

Term Account placement and payment to be processed authentication through

withdrawal. instantly without waiting for Two-Factor Authentication

batch processing windows. (2FA) Tokens.

The New iBiz Muamalat provides businesses with greater introducing personalised engagement strategies to foster

efficiency, security, and flexibility in managing their banking stronger customer relationships.

transactions. Since its launch on June 2024 with payment

capabilities, New iBIZ has successfully onboarded 1,022 new TBD also leveraged internal synergies through the M1 Group

business customers. This has translated into 9,073 payment Synergy initiative, identifying and capitalising on opportunities

transactions, with a total transaction value amounting to within the broader banking group. A key strategic deployment

RM838.9 million, underscoring the platform's early adoption involved assigning 16 State Business Managers across

and utility. Malaysia, with one manager for each of the 13 states and

additional coverage for larger states. This decentralised

TBD implemented several strategic actions. These approach aims to strengthen the Bank’s regional presence

included improving customer training to facilitate greater and expand its reach across diverse industries and customer

understanding and utilisation of new features, simplifying segments.

onboarding processes to reduce friction for new users, and

OUTLOOK & STRATEGY

Moving into FY2025, TBD remains focused on expanding deposit growth, strengthening cash management solutions,

and enhancing customer engagement. With increasing competition in the deposit market, growth will be driven through

targeted acquisition of NTB (New-To-Bank) customers, particularly high-value Corporates, Commercial and SMEs,

while deepening relationships with existing customers to increase wallet share.

To drive growth in FY2025, the TBD will focus on boosting current account growth by strengthening the penetration

of operating accounts among business customers, which will help enhance CASA composition. The Bank also aims to

expand its cash management services, particularly by increasing the adoption of New iBIZ through tailored onboarding

programmes and training, ultimately driving higher collection and payment transactions.

Additionally, to stay ahead in the competitive landscape, customer experience will be optimised, and banking processes

streamlined. These strategic actions are aimed at not only boosting transaction volumes and deposit growth but also

positioning TBD as the go-to banking partner for businesses across various sectors.

By expanding its focus on varied customer groups, the Bank strives to ensure a well-balanced funding mix that provides

stability against market fluctuations. This approach will help drive consistent deposit growth and strengthen customer

loyalty across different segments. These targeted efforts ensure resilience and long-term success in a dynamic environment.