Page 71 - Bank Muamalat_AR24

P. 71

ANNUAL REPORT 2024 1 2 3 4 Our Business Performance 5 6 7 8 69

CORPORATE BANKING

The Corporate Banking Division (CBD) manages the Bank’s

Revenue corporate customers, forging strong client relationships

RM310 million while maximising good-quality assets and minimising

(8.2% YoY) non-performing assets. Responsibilities include providing

a full suite of banking requirements; performing credit

evaluation for new financing applications; and financing

renewal requests. As at 31 December 2024, CBD successfully

managed RM6.4 billion of financing assets, with 33% of the financing assets granted to

financial and insurance/takaful sectors, 16% to the real estate sector, 13% to the wholesale

and retail trade sectors, and 11.9% to the manufacturing sector. Consequentially,

over RM1,298 million in financing was approved, with over RM1,277 million disbursed

by the close of the fiscal year.

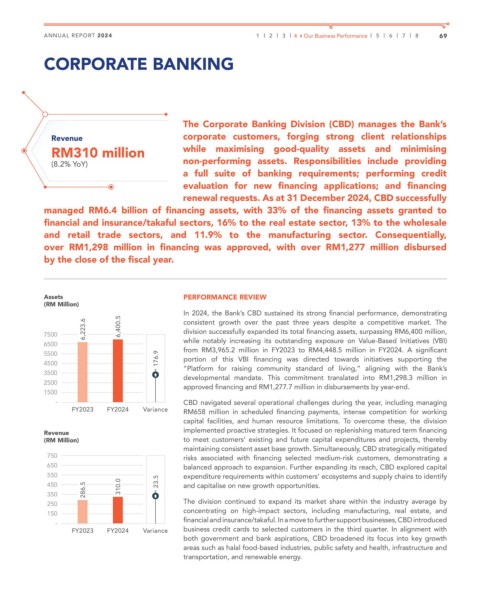

Assets PERFORMANCE REVIEW

(RM Million)

In 2024, the Bank’s CBD sustained its strong financial performance, demonstrating

6,223.6 6,400.5 consistent growth over the past three years despite a competitive market. The

division successfully expanded its total financing assets, surpassing RM6,400 million,

7500

6500 while notably increasing its outstanding exposure on Value-Based Initiatives (VBI)

5500 176.9 from RM3,965.2 million in FY2023 to RM4,448.5 million in FY2024. A significant

portion of this VBI financing was directed towards initiatives supporting the

4500 “Platform for raising community standard of living,” aligning with the Bank’s

3500 developmental mandate. This commitment translated into RM1,298.3 million in

2500 approved financing and RM1,277.7 million in disbursements by year-end.

1500

- CBD navigated several operational challenges during the year, including managing

FY2023 FY2024 Variance RM658 million in scheduled financing payments, intense competition for working

capital facilities, and human resource limitations. To overcome these, the division

Revenue implemented proactive strategies. It focused on replenishing matured term financing

(RM Million) to meet customers’ existing and future capital expenditures and projects, thereby

maintaining consistent asset base growth. Simultaneously, CBD strategically mitigated

750 risks associated with financing selected medium-risk customers, demonstrating a

650 balanced approach to expansion. Further expanding its reach, CBD explored capital

550 expenditure requirements within customers’ ecosystems and supply chains to identify

450 310.0 23.5 and capitalise on new growth opportunities.

350 286.5

250 The division continued to expand its market share within the industry average by

150 concentrating on high-impact sectors, including manufacturing, real estate, and

- financial and insurance/takaful. In a move to further support businesses, CBD introduced

FY2023 FY2024 Variance business credit cards to selected customers in the third quarter. In alignment with

both government and bank aspirations, CBD broadened its focus into key growth

areas such as halal food-based industries, public safety and health, infrastructure and

transportation, and renewable energy.