Page 93 - HRC_Annual_Report_2023

P. 93

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 91

Other Information

INDEPENDENT AUDITORS’ REPORT

TO THE MEMBERS OF HENGYUAN REFINING COMPANY BERHAD

(INCORPORATED IN MALAYSIA)

REGISTRATION NO. 196001000259 (3926-U)

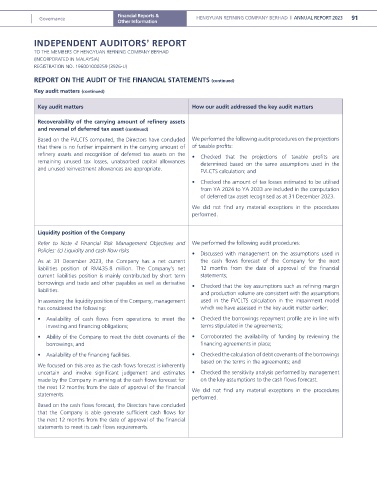

REPORT ON THE AUDIT OF THE FINANCIAL STATEMENTS (continued)

Key audit matters (continued)

Key audit matters How our audit addressed the key audit matters

Recoverability of the carrying amount of refinery assets

and reversal of deferred tax asset (continued)

Based on the FVLCTS computed, the Directors have concluded We performed the following audit procedures on the projections

that there is no further impairment in the carrying amount of of taxable profits:

refinery assets and recognition of deferred tax assets on the • Checked that the projections of taxable profits are

remaining unused tax losses, unabsorbed capital allowances determined based on the same assumptions used in the

and unused reinvestment allowances are appropriate. FVLCTS calculation; and

• Checked the amount of tax losses estimated to be utilised

from YA 2024 to YA 2033 are included in the computation

of deferred tax asset recognised as at 31 December 2023.

We did not find any material exceptions in the procedures

performed.

Liquidity position of the Company

Refer to Note 4 Financial Risk Management Objectives and We performed the following audit procedures:

Policies: (c) Liquidity and cash flow risks

• Discussed with management on the assumptions used in

As at 31 December 2023, the Company has a net current the cash flows forecast of the Company for the next

liabilities position of RM435.8 million. The Company’s net 12 months from the date of approval of the financial

current liabilities position is mainly contributed by short term statements;

borrowings and trade and other payables as well as derivative • Checked that the key assumptions such as refining margin

liabilities.

and production volume are consistent with the assumptions

In assessing the liquidity position of the Company, management used in the FVCLTS calculation in the impairment model

has considered the following: which we have assessed in the key audit matter earlier;

• Availability of cash flows from operations to meet the • Checked the borrowings repayment profile are in line with

investing and financing obligations; terms stipulated in the agreements;

• Ability of the Company to meet the debt covenants of the • Corroborated the availability of funding by reviewing the

borrowings; and financing agreements in place;

• Availability of the financing facilities. • Checked the calculation of debt covenants of the borrowings

based on the terms in the agreements; and

We focused on this area as the cash flows forecast is inherently

uncertain and involve significant judgement and estimates • Checked the sensitivity analysis performed by management

made by the Company in arriving at the cash flows forecast for on the key assumptions to the cash flows forecast.

the next 12 months from the date of approval of the financial We did not find any material exceptions in the procedures

statements.

performed.

Based on the cash flows forecast, the Directors have concluded

that the Company is able generate sufficient cash flows for

the next 12 months from the date of approval of the financial

statements to meet its cash flows requirements.