Page 148 - HRC_Annual_Report_2023

P. 148

146 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

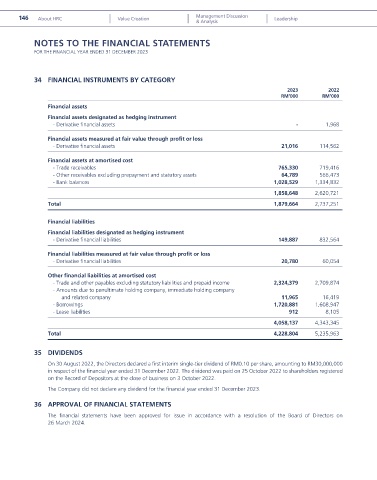

34 FINANCIAL INSTRUMENTS BY CATEGORY

2023 2022

RM’000 RM’000

Financial assets

Financial assets designated as hedging instrument

- Derivative financial assets - 1,968

Financial assets measured at fair value through profit or loss

- Derivative financial assets 21,016 114,562

Financial assets at amortised cost

- Trade receivables 765,330 719,416

- Other receivables excluding prepayment and statutory assets 64,789 566,473

- Bank balances 1,028,529 1,334,832

1,858,648 2,620,721

Total 1,879,664 2,737,251

Financial liabilities

Financial liabilities designated as hedging instrument

- Derivative financial liabilities 149,887 832,564

Financial liabilities measured at fair value through profit or loss

- Derivative financial liabilities 20,780 60,054

Other financial liabilities at amortised cost

- Trade and other payables excluding statutory liabilities and prepaid income 2,324,379 2,709,874

- Amounts due to penultimate holding company, immediate holding company

and related company 11,965 16,419

- Borrowings 1,720,881 1,608,947

- Lease liabilities 912 8,105

4,058,137 4,343,345

Total 4,228,804 5,235,963

35 DIVIDENDS

On 30 August 2022, the Directors declared a first interim single-tier dividend of RM0.10 per share, amounting to RM30,000,000

in respect of the financial year ended 31 December 2022. The dividend was paid on 25 October 2022 to shareholders registered

on the Record of Depositors at the close of business on 3 October 2022.

The Company did not declare any dividend for the financial year ended 31 December 2023.

36 APPROVAL OF FINANCIAL STATEMENTS

The financial statements have been approved for issue in accordance with a resolution of the Board of Directors on

26 March 2024.