Page 144 - HRC_Annual_Report_2023

P. 144

142 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

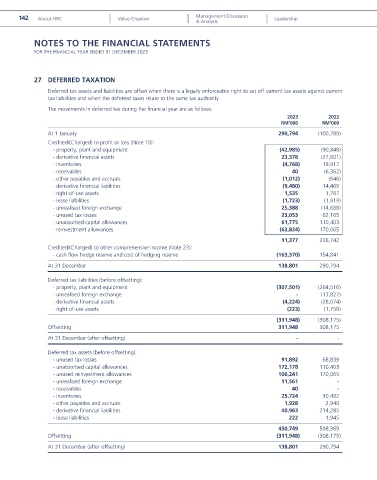

27 DEFERRED TAXATION

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current

tax liabilities and when the deferred taxes relate to the same tax authority.

The movements in deferred tax during the financial year are as follows:

2023 2022

RM’000 RM’000

At 1 January 290,794 (100,789)

Credited/(Charged) to profit or loss (Note 10):

- property, plant and equipment (42,985) (90,848)

- derivative financial assets 23,378 (27,601)

- inventories (4,768) 19,917

- receivables 40 (6,362)

- other payables and accruals (1,012) (646)

- derivative financial liabilities (9,480) 14,469

- right-of-use assets 1,535 1,787

- lease liabilities (1,723) (1,919)

- unrealised foreign exchange 25,388 (14,688)

- unused tax losses 23,053 62,165

- unabsorbed capital allowances 61,775 110,403

- reinvestment allowances (63,824) 170,065

11,377 236,742

Credited/(Charged) to other comprehensive income (Note 23):

- cash flow hedge reserve and cost of hedging reserve (163,370) 154,841

At 31 December 138,801 290,794

Deferred tax liabilities (before offsetting):

- property, plant and equipment (307,501) (264,516)

- unrealised foreign exchange - (13,827)

- derivative financial assets (4,224) (28,074)

- right-of-use assets (223) (1,758)

(311,948) (308,175)

Offsetting 311,948 308,175

At 31 December (after offsetting) - -

Deferred tax assets (before offsetting):

- unused tax losses 91,892 68,839

- unabsorbed capital allowances 172,178 110,403

- unused reinvestment allowances 106,241 170,065

- unrealised foreign exchange 11,561 -

- receivables 40 -

- inventories 25,724 30,492

- other payables and accruals 1,928 2,940

- derivative financial liabilities 40,963 214,285

- lease liabilities 222 1,945

450,749 598,969

Offsetting (311,948) (308,175)

At 31 December (after offsetting) 138,801 290,794