Page 142 - HRC_Annual_Report_2023

P. 142

140 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

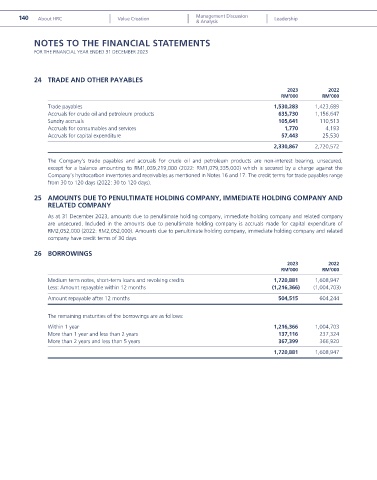

24 TRADE AND OTHER PAYABLES

2023 2022

RM’000 RM’000

Trade payables 1,530,283 1,423,689

Accruals for crude oil and petroleum products 635,730 1,156,647

Sundry accruals 105,641 110,513

Accruals for consumables and services 1,770 4,193

Accruals for capital expenditure 57,443 25,530

2,330,867 2,720,572

The Company’s trade payables and accruals for crude oil and petroleum products are non-interest bearing, unsecured,

except for a balance amounting to RM1,039,219,000 (2022: RM1,079,335,000) which is secured by a charge against the

Company’s hydrocarbon inventories and receivables as mentioned in Notes 16 and 17. The credit terms for trade payables range

from 30 to 120 days (2022: 30 to 120 days).

25 AMOUNTS DUE TO PENULTIMATE HOLDING COMPANY, IMMEDIATE HOLDING COMPANY AND

RELATED COMPANY

As at 31 December 2023, amounts due to penultimate holding company, immediate holding company and related company

are unsecured. Included in the amounts due to penultimate holding company is accruals made for capital expenditure of

RM2,052,000 (2022: RM2,052,000). Amounts due to penultimate holding company, immediate holding company and related

company have credit terms of 30 days.

26 BORROWINGS

2023 2022

RM’000 RM’000

Medium term notes, short-term loans and revolving credits 1,720,881 1,608,947

Less: Amount repayable within 12 months (1,216,366) (1,004,703)

Amount repayable after 12 months 504,515 604,244

The remaining maturities of the borrowings are as follows:

Within 1 year 1,216,366 1,004,703

More than 1 year and less than 2 years 137,116 237,324

More than 2 years and less than 5 years 367,399 366,920

1,720,881 1,608,947