Page 137 - HRC_Annual_Report_2023

P. 137

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 135

Other Information

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

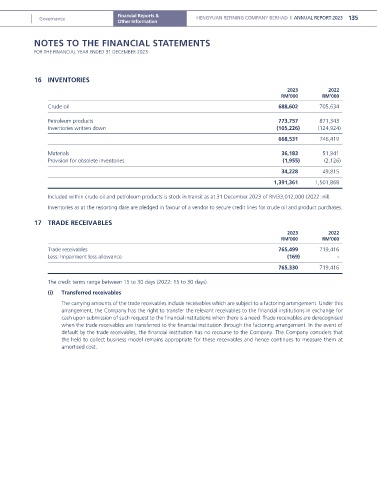

16 INVENTORIES

2023 2022

RM’000 RM’000

Crude oil 688,602 705,634

Petroleum products 773,757 871,343

Inventories written down (105,226) (124,924)

668,531 746,419

Materials 36,183 51,941

Provision for obsolete inventories (1,955) (2,126)

34,228 49,815

1,391,361 1,501,868

Included within crude oil and petroleum products is stock in transit as at 31 December 2023 of RM33,012,000 (2022: nil).

Inventories as at the reporting date are pledged in favour of a vendor to secure credit lines for crude oil and product purchases.

17 TRADE RECEIVABLES

2023 2022

RM’000 RM’000

Trade receivables 765,499 719,416

Less: Impairment loss allowance (169) -

765,330 719,416

The credit terms range between 15 to 30 days (2022: 15 to 30 days).

(i) Transferred receivables

The carrying amounts of the trade receivables include receivables which are subject to a factoring arrangement. Under this

arrangement, the Company has the right to transfer the relevant receivables to the financial institutions in exchange for

cash upon submission of such request to the financial institutions when there is a need. Trade receivables are derecognised

when the trade receivables are transferred to the financial institution through the factoring arrangement. In the event of

default by the trade receivables, the financial institution has no recourse to the Company. The Company considers that

the held to collect business model remains appropriate for these receivables and hence continues to measure them at

amortised cost.