Page 140 - HRC_Annual_Report_2023

P. 140

138 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

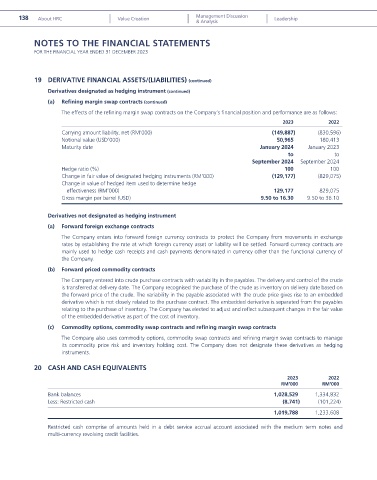

19 DERIVATIVE FINANCIAL ASSETS/(LIABILITIES) (continued)

Derivatives designated as hedging instrument (continued)

(a) Refining margin swap contracts (continued)

The effects of the refining margin swap contracts on the Company’s financial position and performance are as follows:

2023 2022

Carrying amount liability, net (RM’000) (149,887) (830,596)

Notional value (USD’000) 50,965 180,413

Maturity date January 2024 January 2023

to to

September 2024 September 2024

Hedge ratio (%) 100 100

Change in fair value of designated hedging instruments (RM’000) (129,177) (829,075)

Change in value of hedged item used to determine hedge

effectiveness (RM’000) 129,177 829,075

Gross margin per barrel (USD) 9.50 to 16.30 9.50 to 36.10

Derivatives not designated as hedging instrument

(a) Forward foreign exchange contracts

The Company enters into forward foreign currency contracts to protect the Company from movements in exchange

rates by establishing the rate at which foreign currency asset or liability will be settled. Forward currency contracts are

mainly used to hedge cash receipts and cash payments denominated in currency other than the functional currency of

the Company.

(b) Forward priced commodity contracts

The Company entered into crude purchase contracts with variability in the payables. The delivery and control of the crude

is transferred at delivery date. The Company recognised the purchase of the crude as inventory on delivery date based on

the forward price of the crude. The variability in the payable associated with the crude price gives rise to an embedded

derivative which is not closely related to the purchase contract. The embedded derivative is separated from the payables

relating to the purchase of inventory. The Company has elected to adjust and reflect subsequent changes in the fair value

of the embedded derivative as part of the cost of inventory.

(c) Commodity options, commodity swap contracts and refining margin swap contracts

The Company also uses commodity options, commodity swap contracts and refining margin swap contracts to manage

its commodity price risk and inventory holding cost. The Company does not designate these derivatives as hedging

instruments.

20 CASH AND CASH EQUIVALENTS

2023 2022

RM’000 RM’000

Bank balances 1,028,529 1,334,832

Less: Restricted cash (8,741) (101,224)

1,019,788 1,233,608

Restricted cash comprise of amounts held in a debt service accrual account associated with the medium term notes and

multi-currency revolving credit facilities.