Page 145 - HRC_Annual_Report_2023

P. 145

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 143

Other Information

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

27 DEFERRED TAXATION (continued)

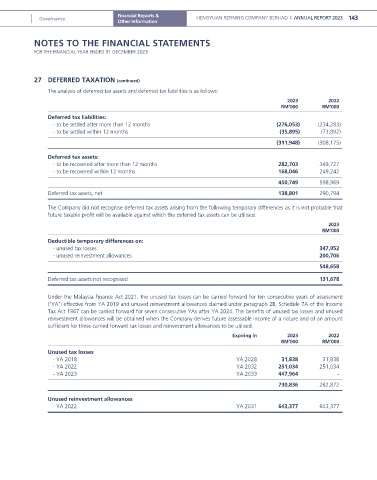

The analysis of deferred tax assets and deferred tax liabilities is as follows:

2023 2022

RM’000 RM’000

Deferred tax liabilities:

- to be settled after more than 12 months (276,053) (234,283)

- to be settled within 12 months (35,895) (73,892)

(311,948) (308,175)

Deferred tax assets:

- to be recovered after more than 12 months 282,703 349,727

- to be recovered within 12 months 168,046 249,242

450,749 598,969

Deferred tax assets, net 138,801 290,794

The Company did not recognise deferred tax assets arising from the following temporary differences as it is not probable that

future taxable profit will be available against which the deferred tax assets can be utilised.

2023

RM’000

Deductible temporary differences on:

- unused tax losses 347,952

- unused reinvestment allowances 200,706

548,658

Deferred tax assets not recognised 131,678

Under the Malaysia Finance Act 2021, the unused tax losses can be carried forward for ten consecutive years of assessment

(“YA”) effective from YA 2019 and unused reinvestment allowances claimed under paragraph 2B, Schedule 7A of the Income

Tax Act 1967 can be carried forward for seven consecutive YAs after YA 2024. The benefits of unused tax losses and unused

reinvestment allowances will be obtained when the Company derives future assessable income of a nature and of an amount

sufficient for these carried forward tax losses and reinvestment allowances to be utilised.

Expiring in 2023 2022

RM’000 RM’000

Unused tax losses

- YA 2018 YA 2028 31,838 31,838

- YA 2022 YA 2032 251,034 251,034

- YA 2023 YA 2033 447,964 -

730,836 282,872

Unused reinvestment allowances

- YA 2022 YA 2031 643,377 643,377