Page 143 - HRC_Annual_Report_2023

P. 143

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 141

Other Information

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

26 BORROWINGS (continued)

2023 2022

RM’000 RM’000

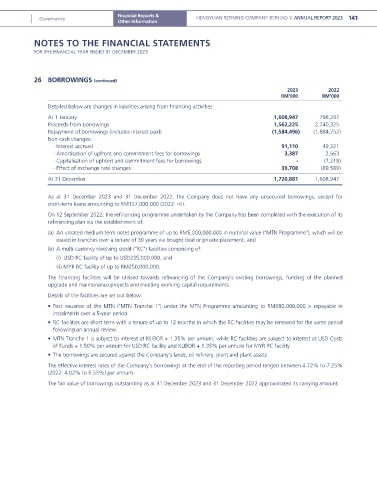

Detailed below are changes in liabilities arising from financing activities:

At 1 January 1,608,947 798,297

Proceeds from borrowings 1,562,225 2,740,325

Repayment of borrowings (includes interest paid) (1,584,496) (1,884,752)

Non-cash changes:

- Interest accrued 91,110 49,321

- Amortisation of upfront and commitment fees for borrowings 3,387 2,563

- Capitalisation of upfront and commitment fees for borrowings - (7,218)

- Effect of exchange rate changes 39,708 (89,589)

At 31 December 1,720,881 1,608,947

As at 31 December 2023 and 31 December 2022, the Company does not have any unsecured borrowings, except for

short-term loans amounting to RM157,000,000 (2022: nil).

On 12 September 2022, the refinancing programme undertaken by the Company has been completed with the execution of its

refinancing plan via the establishment of:

(a) An unrated medium term notes programme of up to RM5,000,000,000 in nominal value (“MTN Programme”), which will be

issued in tranches over a tenure of 30 years via bought deal or private placement, and

(b) A multi-currency revolving credit (“RC”) facilities comprising of:

(i) USD RC facility of up to USD235,000,000, and

(ii) MYR RC facility of up to RM250,000,000.

The financing facilities will be utilised towards refinancing of the Company’s existing borrowings, funding of the planned

upgrade and maintenance projects and meeting working capital requirements.

Details of the facilities are set out below:

• First issuance of the MTN (“MTN Tranche 1”) under the MTN Programme amounting to RM680,000,000 is repayable in

instalments over a 5-year period.

• RC facilities are short term with a tenure of up to 12 months in which the RC facilities may be renewed for the same period

following an annual review.

• MTN Tranche 1 is subject to interest at KLIBOR + 1.35% per annum, while RC facilities are subject to interest at USD Costs

of Funds + 1.50% per annum for USD RC facility and KLIBOR + 1.35% per annum for MYR RC facility.

• The borrowings are secured against the Company’s lands, oil refinery, plant and plant assets.

The effective interest rates of the Company’s borrowings at the end of the reporting period ranged between 4.72% to 7.25%

(2022: 4.02% to 6.55%) per annum.

The fair value of borrowings outstanding as at 31 December 2023 and 31 December 2022 approximated its carrying amount.