Page 139 - HRC_Annual_Report_2023

P. 139

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 137

Other Information

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

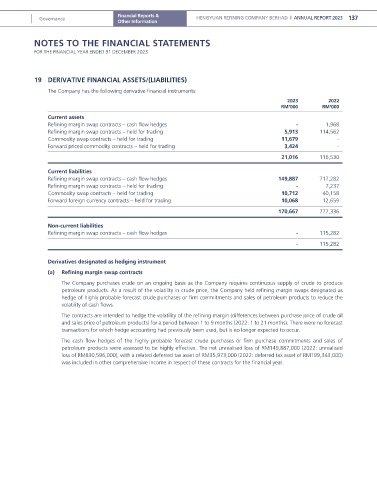

19 DERIVATIVE FINANCIAL ASSETS/(LIABILITIES)

The Company has the following derivative financial instruments:

2023 2022

RM’000 RM’000

Current assets

Refining margin swap contracts – cash flow hedges - 1,968

Refining margin swap contracts – held for trading 5,913 114,562

Commodity swap contracts – held for trading 11,679 -

Forward priced commodity contracts – held for trading 3,424 -

21,016 116,530

Current liabilities

Refining margin swap contracts – cash flow hedges 149,887 717,282

Refining margin swap contracts – held for trading - 7,237

Commodity swap contracts – held for trading 10,712 40,158

Forward foreign currency contracts – held for trading 10,068 12,659

170,667 777,336

Non-current liabilities

Refining margin swap contracts – cash flow hedges - 115,282

- 115,282

Derivatives designated as hedging instrument

(a) Refining margin swap contracts

The Company purchases crude on an ongoing basis as the Company requires continuous supply of crude to produce

petroleum products. As a result of the volatility in crude price, the Company held refining margin swaps designated as

hedge of highly probable forecast crude purchases or firm commitments and sales of petroleum products to reduce the

volatility of cash flows.

The contracts are intended to hedge the volatility of the refining margin (differences between purchase price of crude oil

and sales price of petroleum products) for a period between 1 to 9 months (2022: 1 to 21 months). There were no forecast

transactions for which hedge accounting had previously been used, but is no longer expected to occur.

The cash flow hedges of the highly probable forecast crude purchases or firm purchase commitments and sales of

petroleum products were assessed to be highly effective. The net unrealised loss of RM149,887,000 (2022: unrealised

loss of RM830,596,000), with a related deferred tax asset of RM35,973,000 (2022: deferred tax asset of RM199,343,000)

was included in other comprehensive income in respect of these contracts for the financial year.