Page 138 - HRC_Annual_Report_2023

P. 138

136 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

17 TRADE RECEIVABLES (continued)

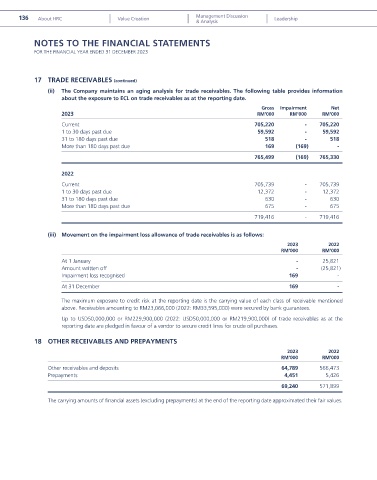

(ii) The Company maintains an aging analysis for trade receivables. The following table provides information

about the exposure to ECL on trade receivables as at the reporting date.

Gross Impairment Net

2023 RM’000 RM’000 RM’000

Current 705,220 - 705,220

1 to 30 days past due 59,592 - 59,592

31 to 180 days past due 518 - 518

More than 180 days past due 169 (169) -

765,499 (169) 765,330

2022

Current 705,739 - 705,739

1 to 30 days past due 12,372 - 12,372

31 to 180 days past due 630 - 630

More than 180 days past due 675 - 675

719,416 - 719,416

(iii) Movement on the impairment loss allowance of trade receivables is as follows:

2023 2022

RM’000 RM’000

At 1 January - 25,821

Amount written off - (25,821)

Impairment loss recognised 169 -

At 31 December 169 -

The maximum exposure to credit risk at the reporting date is the carrying value of each class of receivable mentioned

above. Receivables amounting to RM23,066,000 (2022: RM33,595,000) were secured by bank guarantees.

Up to USD50,000,000 or RM229,900,000 (2022: USD50,000,000 or RM219,900,000) of trade receivables as at the

reporting date are pledged in favour of a vendor to secure credit lines for crude oil purchases.

18 OTHER RECEIVABLES AND PREPAYMENTS

2023 2022

RM’000 RM’000

Other receivables and deposits 64,789 566,473

Prepayments 4,451 5,426

69,240 571,899

The carrying amounts of financial assets (excluding prepayments) at the end of the reporting date approximated their fair values.