Page 133 - HRC_Annual_Report_2023

P. 133

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 131

Other Information

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

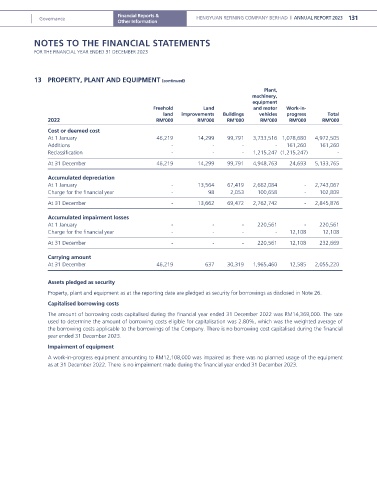

13 PROPERTY, PLANT AND EQUIPMENT (continued)

Plant,

machinery,

equipment

Freehold Land and motor Work-in-

land improvements Buildings vehicles progress Total

2022 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Cost or deemed cost

At 1 January 46,219 14,299 99,791 3,733,516 1,078,680 4,972,505

Additions - - - - 161,260 161,260

Reclassification - - - 1,215,247 (1,215,247) -

At 31 December 46,219 14,299 99,791 4,948,763 24,693 5,133,765

Accumulated depreciation

At 1 January - 13,564 67,419 2,662,084 - 2,743,067

Charge for the financial year - 98 2,053 100,658 - 102,809

At 31 December - 13,662 69,472 2,762,742 - 2,845,876

Accumulated impairment losses

At 1 January - - - 220,561 - 220,561

Charge for the financial year - - - - 12,108 12,108

At 31 December - - - 220,561 12,108 232,669

Carrying amount

At 31 December 46,219 637 30,319 1,965,460 12,585 2,055,220

Assets pledged as security

Property, plant and equipment as at the reporting date are pledged as security for borrowings as disclosed in Note 26.

Capitalised borrowing costs

The amount of borrowing costs capitalised during the financial year ended 31 December 2022 was RM14,369,000. The rate

used to determine the amount of borrowing costs eligible for capitalisation was 2.80%, which was the weighted average of

the borrowing costs applicable to the borrowings of the Company. There is no borrowing cost capitalised during the financial

year ended 31 December 2023.

Impairment of equipment

A work-in-progress equipment amounting to RM12,108,000 was impaired as there was no planned usage of the equipment

as at 31 December 2022. There is no impairment made during the financial year ended 31 December 2023.