Page 128 - HRC_Annual_Report_2023

P. 128

126 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

5 FAIR VALUE MEASUREMENTS (continued)

Fair value hierarchy (continued)

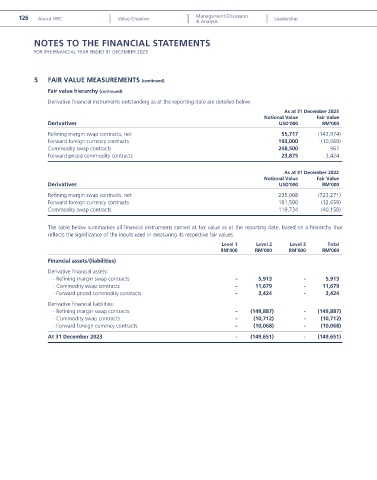

Derivative financial instruments outstanding as at the reporting date are detailed below:

As at 31 December 2023

Notional Value Fair Value

Derivatives USD’000 RM’000

Refining margin swap contracts, net 55,717 (143,974)

Forward foreign currency contracts 193,000 (10,068)

Commodity swap contracts 248,500 967

Forward priced commodity contracts 23,875 3,424

As at 31 December 2022

Notional Value Fair Value

Derivatives USD’000 RM’000

Refining margin swap contracts, net 235,068 (723,271)

Forward foreign currency contracts 181,500 (12,659)

Commodity swap contracts 119,734 (40,158)

The table below summarises all financial instruments carried at fair value as at the reporting date, based on a hierarchy that

reflects the significance of the inputs used in measuring its respective fair values.

Level 1 Level 2 Level 3 Total

RM’000 RM’000 RM’000 RM’000

Financial assets/(liabilities)

Derivative financial assets:

- Refining margin swap contracts - 5,913 - 5,913

- Commodity swap contracts - 11,679 - 11,679

- Forward priced commodity contracts - 3,424 - 3,424

Derivative financial liabilities:

- Refining margin swap contracts - (149,887) - (149,887)

- Commodity swap contracts - (10,712) - (10,712)

- Forward foreign currency contracts - (10,068) - (10,068)

At 31 December 2023 - (149,651) - (149,651)