Page 124 - HRC_Annual_Report_2023

P. 124

122 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)

(a) Market risk (continued)

(iii) Commodity price risk and refining margin risk (continued)

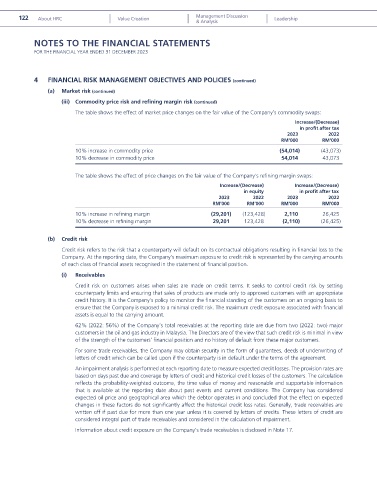

The table shows the effect of market price changes on the fair value of the Company’s commodity swaps:

Increase/(Decrease)

in profit after tax

2023 2022

RM’000 RM’000

10% increase in commodity price (54,014) (43,073)

10% decrease in commodity price 54,014 43,073

The table shows the effect of price changes on the fair value of the Company’s refining margin swaps:

Increase/(Decrease) Increase/(Decrease)

in equity in profit after tax

2023 2022 2023 2022

RM’000 RM’000 RM’000 RM’000

10% increase in refining margin (29,201) (123,428) 2,110 26,425

10% decrease in refining margin 29,201 123,428 (2,110) (26,425)

(b) Credit risk

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in financial loss to the

Company. At the reporting date, the Company’s maximum exposure to credit risk is represented by the carrying amounts

of each class of financial assets recognised in the statement of financial position.

(i) Receivables

Credit risk on customers arises when sales are made on credit terms. It seeks to control credit risk by setting

counterparty limits and ensuring that sales of products are made only to approved customers with an appropriate

credit history. It is the Company’s policy to monitor the financial standing of the customers on an ongoing basis to

ensure that the Company is exposed to a minimal credit risk. The maximum credit exposure associated with financial

assets is equal to the carrying amount.

62% (2022: 56%) of the Company’s total receivables at the reporting date are due from two (2022: two) major

customers in the oil and gas industry in Malaysia. The Directors are of the view that such credit risk is minimal in view

of the strength of the customers’ financial position and no history of default from these major customers.

For some trade receivables, the Company may obtain security in the form of guarantees, deeds of underwriting of

letters of credit which can be called upon if the counterparty is in default under the terms of the agreement.

An impairment analysis is performed at each reporting date to measure expected credit losses. The provision rates are

based on days past due and coverage by letters of credit and historical credit losses of the customers. The calculation

reflects the probability-weighted outcome, the time value of money and reasonable and supportable information

that is available at the reporting date about past events and current conditions. The Company has considered

expected oil price and geographical area which the debtor operates in and concluded that the effect on expected

changes in these factors do not significantly affect the historical credit loss rates. Generally, trade receivables are

written off if past due for more than one year unless it is covered by letters of credits. These letters of credit are

considered integral part of trade receivables and considered in the calculation of impairment.

Information about credit exposure on the Company’s trade receivables is disclosed in Note 17.