Page 127 - HRC_Annual_Report_2023

P. 127

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 125

Other Information

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)

(d) Capital risk management

The Company’s objectives when managing capital are:

• to safeguard the Company’s ability to continue as a going concern;

• to maximise returns for shareholders; and

• to maintain an optimal capital structure which minimises the cost of capital while maintaining sufficient liquidity.

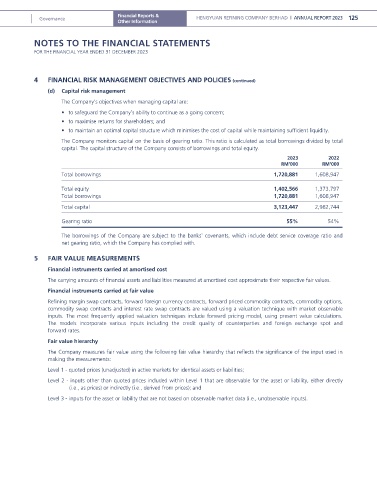

The Company monitors capital on the basis of gearing ratio. This ratio is calculated as total borrowings divided by total

capital. The capital structure of the Company consists of borrowings and total equity.

2023 2022

RM’000 RM’000

Total borrowings 1,720,881 1,608,947

Total equity 1,402,566 1,373,797

Total borrowings 1,720,881 1,608,947

Total capital 3,123,447 2,982,744

Gearing ratio 55% 54%

The borrowings of the Company are subject to the banks’ covenants, which include debt service coverage ratio and

net gearing ratio, which the Company has complied with.

5 FAIR VALUE MEASUREMENTS

Financial instruments carried at amortised cost

The carrying amounts of financial assets and liabilities measured at amortised cost approximate their respective fair values.

Financial instruments carried at fair value

Refining margin swap contracts, forward foreign currency contracts, forward priced commodity contracts, commodity options,

commodity swap contracts and interest rate swap contracts are valued using a valuation technique with market observable

inputs. The most frequently applied valuation techniques include forward pricing model, using present value calculations.

The models incorporate various inputs including the credit quality of counterparties and foreign exchange spot and

forward rates.

Fair value hierarchy

The Company measures fair value using the following fair value hierarchy that reflects the significance of the input used in

making the measurements:

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 - inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly

(i.e., as prices) or indirectly (i.e., derived from prices); and

Level 3 - inputs for the asset or liability that are not based on observable market data (i.e., unobservable inputs).